Update from China – are there positive signs ahead in the Year of the Dragon?

In 2024, we entered the Year of the Dragon, the zodiac sign for strength, power and good fortune. After three years of weak performance and some tentative signs of a stock market recovery, we are often asked if it's finally time to look at China again. We believe there are five reasons why investors should consider taking another look.

Before we begin, it is important to note that China has three very distinct equity markets, each with its own characteristics and drivers. These are the onshore A-shares market, the offshore H-shares market (listed in Hong Kong) and the US-listed ADR (American Depository Receipts) market. The A-share market has the highest exposure to state-owned enterprises and participants tend to be domestic institutional investors, retail investors and a limited number of qualified international investors. The H-share market, on the other hand, has more “new economy” companies, such as internet and healthcare companies, and is more accessible to international investors. US-listed names also tend to have a new economy bias and are clearly more exposed to the US sentiment towards China.

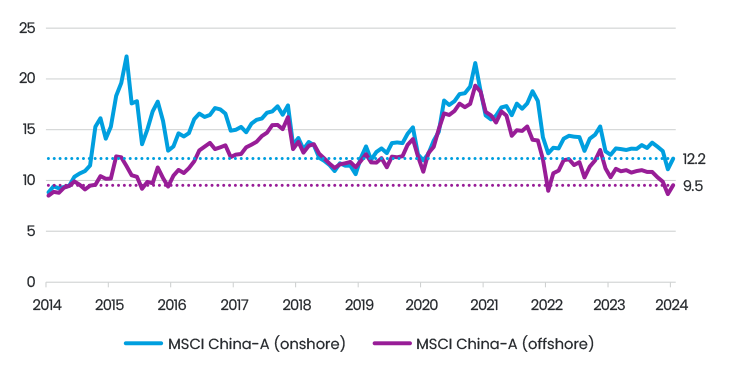

1. Chinese markets are trading at historically low valuations, particularly in the offshore markets.

Long COVID shutdowns, geopolitics and concerns over economic growth have led to consistent selling pressure in the market since its peak in early 2021. As a result, China's valuation continues to trend down to historical lows, as shown in Figure 1. This is particularly the case for offshore listed companies. For example, the largest solar panel maker, Jinko Solar, trades at 11.5x P/E 2024 on the A-share market, but its US-listed ADR trades at 4.0x P/E 2024, or a 65% discount to the A-share market. Similarly, Flat Glass, a leading solar glass maker, trades at 18.7x P/E 2024 on the A-share market but at 12.4x P/E 2024 on the Hong Kong H-share market. As a result, we see

opportunities in the discrepancies between the markets.

12-month forward P/E ratios for the Chinese indices

2. The Chinese government has been steadily rolling out supportive policies.

China is not aiming for a "big bang" stimulus, but rather a steady drip-feed of positive measures. We have seen expansionary monetary policy, such as a cut in key interest rates in January and February of this year; expansionary fiscal policy, such as the issuance of RMB 4 trillion in special local government bonds to boost infrastructure spending; support for consumption, by encouraging large-scale equipment upgrades and trade-ins of consumer goods; support for property markets, by easing housing policies across the country; and support for local governments with debt risks, by allowing them to issue bonds for repayment. All these measures will provide solid support to the fragile economy.

3. CSRC has stepped up efforts to stabilise the market and restore investor confidence.

On 7 February, just before the Chinese New Year, China replaced the head of its securities regulator, the China Securities Regulatory Commission (CSRC). The new Chairman, Wu Qing, reportedly did not take a holiday during the Chinese New Year and instead has been rolling out measures such as restricting high-frequency trading of quant funds, banning stock lending during lockup periods and investigating and punishing financial reporting misconduct. The CSRC has also acted to limit dilutive share issuance and encourage dividends and buybacks. Following Chairman Wu’s appointment and the announcement of forceful measures, Chinese markets recovered from their short-term lows in early February.

4. The “national team” has supported the market by buying ETFs.

China’s “national team” includes the sovereign wealth fund, Central Huijin Investment, and other state funds. Historically, they have entered equity markets when they see extreme weakness, although they have accelerated this process in 2024 following the rapid market decline, partly due to the knock-in of snowball derivatives and the impact from quant fund trading. This has led to an estimated net inflow of more than USD 60 billion from the "national team" via ETFs into the A-share market in Jan/Feb 2024. We believe they will continue to be an important force in stabilising markets during periods of large volatility or sharp corrections.

5. Global investor positioning in China is reaching a multi-year low.

Continued outflows have resulted in positioning below the 10th percentile, at multi-year lows. While hedge funds are taking advantage of short-term opportunities, mutual funds are more cautious, waiting for a fundamental economic recovery. However, in 2024 we have seen a steady inflow from northbound investors buying onshore shares through Hong Kong after steady outflows from August to December 2023. This suggests that interest in China is recovering.

How we build our portfolios

As the offshore Hong Kong and US markets have become even more beaten down, we have recently been bottom fishing on a highly selective basis for companies where fundamentals and capital returns remain robust. Here are some examples:

China Education Group (839 HK) is the largest private higher-education group in China. The company has 248,000 full-time students at its 10 private universities and 4 vocational schools. We expect a revenue CAGR of 15% over 2024-2026, driven by a 5% increase in revenue per student, 10% enrollment growth and potential M&A activity. The company trades at 5.0x P/E with 10% EPS growth and 9% dividend yield for 2024.

United Laboratories (3933 HK) is a supplier of the key ingredient for antibiotics as well as finished pharmaceuticals such as insulin and veterinary drugs. We expect the core business to remain stable as prices are likely to remain resilient given limited capacity additions due to high barriers to entry. We are positive about the company’s pipeline, including its semaglutide biosimilar (2027e launch), which positions the company well in the fast-developing GLP-1 drug market. With Novo Nordisk’s Semaglutide receiving approval from Chinese authorities on 26 Jan 2024, we continue to see smooth development in the GLP-1 market in China. The company is trading at 7.1x FY24 P/E and offering 11% earnings CAGR from 2023 to 2025.

LexinFintech (LX US), a microlender that has survived the regulatory axe, has over 200 million registered users and 140+ funding partners. After extensive meetings with the founder and management team, we believe the company is transitioning from rapid expansion to a more risk-focused approach. The company paid its first dividend in 2H2023 with a payout ratio of 20%, resulting in a dividend yield of around 11%. We believe the company has the capacity to pay more in dividends and we are engaging on this topic – for example, a close peer recently distributed 70% of its earnings in the form of share buybacks and cash dividends. The company trades at an extremely low valuation of 1.4x P/E for 2024.

In A-shares we typically focus on high-quality exporters, such as Zhejiang Dingli (603338 CH), which produces battery-powered aerial work platforms; 70% of sales are exported, and hence the company is more of a play on international infrastructure development rather than the Chinese economy. The company already pays high tariffs on its US imports, though it remains competitive, particularly as most of the incumbents focus on diesel-powered platforms, which are louder and more polluting. The company is trading at 14.8x 24P/E versus 15%

EPS growth.

Conclusion

In conclusion, we believe that a lot of bad news is already priced into Chinese markets. However, we believe that in order for the markets to move further, we need to see some stabilisation in the real estate sector and hence an improvement in consumer sentiment. However, it’s clear that when the Chinese market does move, it can move very quickly, the most recent example being the post-November 2022 rally, where the MSCI China returned 60% in just over 3 months.

Share

Share