Emerging and frontier markets outlook 2024 – emerging from the rates storm?

While the last few years have presented a challenging backdrop for risk assets, particularly in emerging and frontier markets, 2024 should provide a more benign environment. Falling rates, a somewhat recovering China and a USD that is unlikely to significantly strengthen should be positive performance drivers for our markets. Nevertheless, with global economic growth slowing as higher interest rates start to bite, it will not be plain sailing, especially as a lot of the good news is already reflected in prices.

Hence, the ‘fat and flat’ (volatile and not particularly spectacular) returns that we discussed in our 2023 outlook remain our base case for 2024. A lot will depend on how soon the Fed is able to start cutting rates and, of course, what happens in China.

A brief look back at 2023

It would be an understatement to say that the last few years have presented a difficult backdrop for equity market performance, thanks to rising inflation and interest rates, slowing economic growth and (for emerging markets) a widely discussed set of structural issues in China. In this context, markets have been surprisingly resilient, even outside the ‘magnificent seven’ in the US.

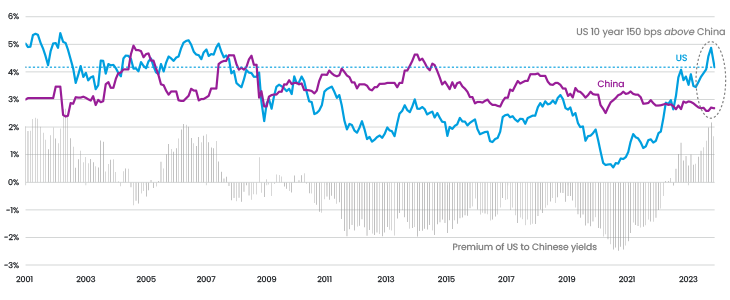

This includes emerging markets, which have been flat since the first Fed rate hike, despite a stronger USD. This is a clear testament to the improved fiscal and monetary frameworks in most countries, with the consensus that emerging markets have generally managed Covid and the subsequent inflationary pressures better than their developed market counterparts. Indeed, China currently has inflation hovering around zero, and for 15 months over the last two years inflation has been higher in the US than in India. It is perhaps even more surprising that several emerging economies have outperformed developed markets since the start of the rate hike cycle, including Mexico and India, which have strong structural growth stories.

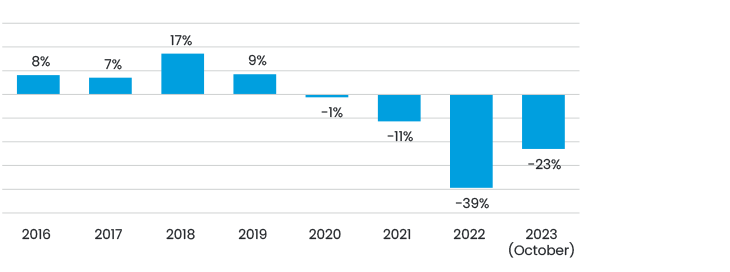

Figure 1. Total return in USD

Rates to remain in the driving seat

Although US yields have come down slightly in the last few months, they are still hovering around their highest levels since 2006. This is likely to put considerable pressure on equity markets, both in terms of theoretical valuations, i.e. future cash flows should be discounted at higher rates, and because financing costs have gone up considerably. Companies we speak to are paying increasing amounts on interest and are having to scale back investments because the return on investment is not sufficient, given the higher cost of debt. The same applies to consumers, who are facing higher interest rates on mortgages and loans, which directly impacts consumption. Given the significant response lag to rising rates, it will only be in 2024 that we start to see what a 5% Fed fund rate really means for the spending choices of both corporations and consumers.

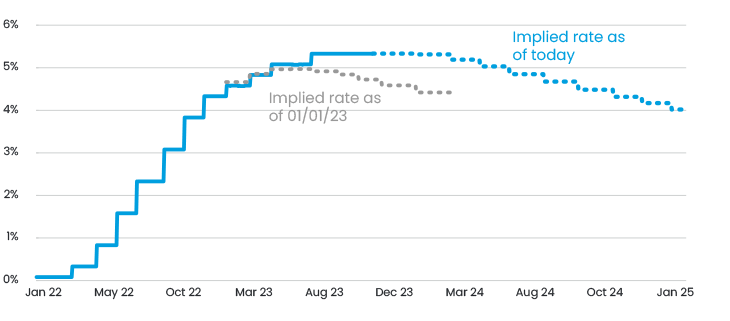

Figure 2. US and Chinese 10 year yields since 2001

What is clear is that we have moved into a new paradigm where capital scarcity replaces the abundant capital and low rates of the post-2008 era. The Fed has already reduced its balance sheet by USD 1 trillion since 2022 and will continue to do so. At the same time, the US is running a 6%+ primary deficit and paying USD 700bn (and soon USD 1 trillion) in interest costs annually. We therefore struggle to see the longer end of the interest rate curve coming down materially, although we do expect Fed rate cuts.

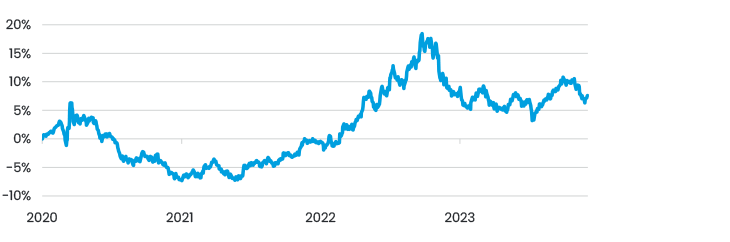

Nevertheless, as in the last few years, the Fed will continue to dominate markets. Implied pricing (Figure 3) suggests the market expects a series of rate cuts from as early as Q2 next year. While this would clearly be well received, if they were to happen, there is a risk that the market has got a little ahead of itself in this regard, which is another reason for us to remain cautious.

Figure 3. Market-implied FED funds rate

One of the most direct impacts of interest rates is on exchange rates, which are a key driver for emerging and frontier markets. The fall in US dollar rates in the last month has illustrated this, with the US dollar weakening 3% in November versus its main currency basket (DXY). As interest rates come down gradually, we would expect the weakening trend in the USD that we’ve started to see over the last few months to continue, although we do not expect any drastic moves. USD strength is one of the primary impediments to EM performance, not least due to pure translation impacts (when earnings growth is lower in USD). However, it also requires central banks to raise rates to defend their currencies, increasing borrowing costs (for FX debt) and impacting trade balances/inflation, due, for example, to oil becoming more expensive in local currency.

Figure 4. US currency index return since 2019

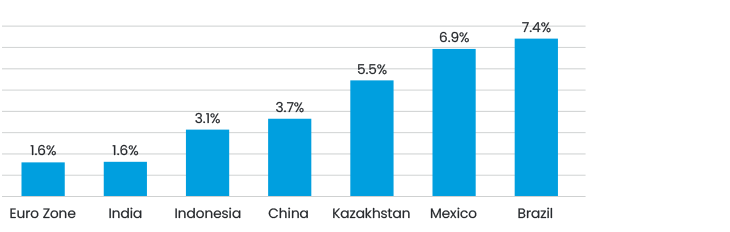

The final point on interest rates is that central bank rates in the countries we invest in are also crucial, given that most of our companies pay debt linked to these rates. It's clear that emerging markets’ central bankers have generally been ahead of the curve when it comes to inflation and rates, and hence have significant headroom to cut rates, most obviously in Latin America. This can be clearly seen in real interest rates (Figure 5). The main reason this hasn’t happened sooner is the increase in Fed rates. As US rates start to come down, we would expect steeper declines in central bank rates in our core countries.

Figure 5. Real interest rates

China will recover, slowly

The list of China’s structural issues has been widely discussed; a struggling real estate sector, overleveraged local governments and poor consumer sentiment with a geopolitical backdrop that remains tense. We follow many macro statistics but the most striking is inflation, which has been hovering around zero for many months. This is due to both prudent macroeconomic policies, i.e. no massive handouts post Covid, and weak demand.

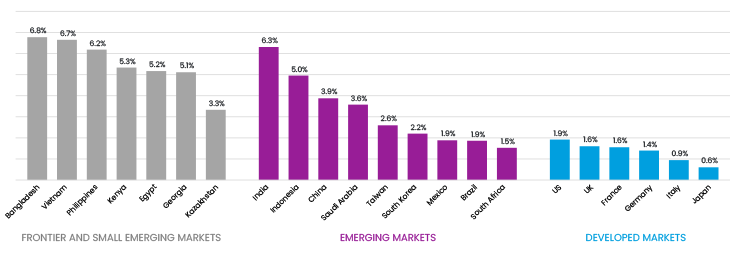

The major problem with the real estate sector is that it totally dominates the Chinese economy, accounting for 30% of Chinese GDP, compared with 7% in India and around 17% in the US (estimates vary). Its impact on the Chinese – and global – economy is therefore very significant and it has long been the major engine of overall economic growth. Going forward, however, this will not be the case; property sales in China’s 30 largest cities were down 15% YoY in November, and new construction starts were down 23% YoY in October. We have seen a raft of policy measures that are helping, and we believe that by the second half of 2024, due partly to the base effect, we will start to see some very modest growth. However, it is difficult to see a return to the solid low double-digit growth seen over the last decade. This has had a correspondingly negative impact on consumer sentiment, which is reflected in flagging retail sales.

Figure 6. China new housing starts YoY (%)

Figure 7. China retail sales YoY (%)

The on-the-ground view in China is that the next growth driver will be higher-end products such as renewable energy, electric vehicles and other advanced technologies. This will certainly be a massive benefit for the world as significant investment is driving down costs globally for key technologies. It is more difficult for equity investors, however, as these sectors in China tend to receive broad-based government support, which, combined with a strong growth mentality, leads to overcapacity and risk of anti-dumping tariffs. For example, the price of solar panels has fallen by 47% year-to-date due to overcapacity at all stages of the solar value chain; nominal panel capacity is upwards of 700GW, whereas demand will be around 390GW for 2023 (+55% YoY). The good news is that this will help the world reach climate goals as the economics of solar projects improves significantly.

Combined, these sectors currently represent some 8% of GDP, so it will be harder for them to move the growth needle compared with real estate. We therefore believe that long-term growth for China will be closer to 4% as opposed to the 5-6% investors were used to previously, but this still represents a very significant 30–40% of global growth.

Geopolitics is not going to go away in 2024. In fact, the noise could ramp up, given the Taiwanese presidential election in January and the US election in November. In China, a potential Taiwanese conflict is viewed differently, and it seems preposterous that anything would or could happen in the short run given that China’s government has much more pressing matters to address. Longer term, however, Taiwan’s status is something that ‘needs to be dealt with’. We have heard a wide variety of views as to how exactly this could happen, although our base case is that the status quo of strained relations and posturing will remain for at least the next few years.

With regard to Chinese valuations, the index looks incredibly cheap at 9x P/E for 2024 on the H-shares (offshore) market, compared with the 10-year average of 11x. However, this somewhat oversimplifies the analysis, partly due to the structural shift in the economy and lower returns on equity, but also because sectors like banks and real estate companies, which we don’t invest in, should be trading much cheaper than previously.

We therefore like to look at valuations at company level. One of the most striking examples is electric vehicle (EV) manufacturer BYD, which is a global leader in its sector. Its cheapest model, the Seagull, sells for around USD 10,000 in China. The company sold roughly the same number of EVs as Tesla in Q3 2023 and the same amount again of hybrid cars and will likely overtake Tesla in Q4. The huge difference in market cap/valuation consequently seems somewhat perplexing, especially when considering the superior growth and return on equity. We believe this is primarily due to the poor sentiment surrounding China.

Figure 8. BYD vs. Tesla, key figures

| Tesla | BYD | |

| EV sales Q3 2023 | 435,059 | 431,603 |

| Total sales (EV + hybrid) Q3 2023 | 435,059 | 824,001 |

| Market cap | USD 748bn | USD 81bn |

| 2024 earnings | USD 13.5bn | USD 5.7bn |

| 2024 PE | 55x | 14x |

| 2024 earnings growth | 22% | 33% |

| 2024 RoE | 19% | 24% |

Source: LSEG Datastream and I/B/E/S Estimates, accessed 06.12.23

Elsewhere, emerging and frontier markets look strong

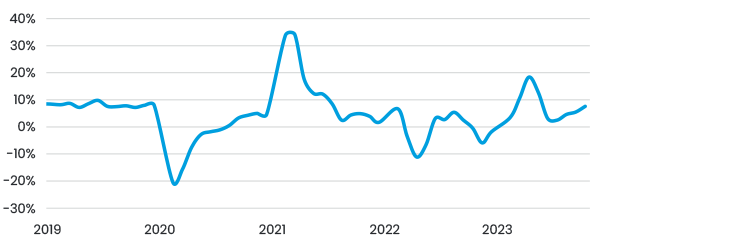

Outside China, the picture is much clearer. Strong GDP growth (Figure 9) combined with falling interest rates (both in the US and domestically) set a good backdrop for equity performance. Countries like Vietnam, Indonesia and the Philippines should provide fertile ground for stock pickers, given the very strong structural growth on offer.

The jewel in the crown of emerging markets is, of course, India. Expected to grow at 6.3% annually between 2023 and 2028, the country is firing on all cylinders at the moment. This is highly visible in the market performance, both in the last few years (Figure 1) and over a longer period, with 10-year CAGR at 10% in USD, compared with 6% in developed markets. This strong performance has meant the country is now the second largest in the emerging markets benchmark, increasing from 9% when we launched the fund in 2019 to 17% today. Going forward, we expect GDP growth to remain comfortably above 6%, inflation to moderate and earnings growth to remain strong, especially in the mid-cap names that we prefer. Consequently, we believe the strong performance will continue. The general election in May is the key risk; while recent state election results suggest Prime Minister Narendra Modi is poised to win a strong majority and a third term, we don’t rule out volatility in the run-up to the vote.

Figure 9 - Average annual GDP growth rate, 5 years between 2023-28e

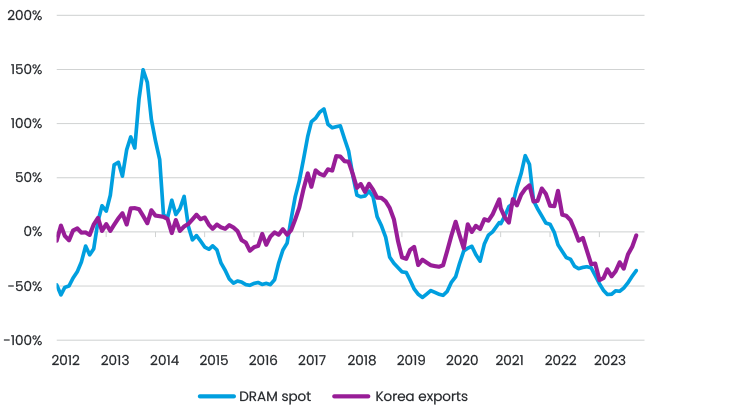

Aside from pure structural growth, a key driver for emerging markets performance is the electronics cycle. The biggest beneficiary is Korea, which produces over 70% of DRAM and 50% of NAND (both types of computer memory). The memory market has undergone one of the worst downcycles ever this year, with multiple quarters of inventory destocking. This has resulted in unprecedented production cuts across the board, which are continuing. However, thanks to prudent capex control and production cutbacks, as well as a cyclical demand recovery from consumer applications, the memory market is beginning to show gradual improvement, which is expected to continue into 2024. This is a focal area for our Global Emerging Market Sustainable fund, especially given that a lot of the stocks have sold off heavily over the last few years.

Figure 10. DRAM and Korean export growth YoY (%)

Elsewhere across the emerging market universe, the Middle East has grown from 2% of the emerging market benchmark in 2019 to 7% today and is benefiting from both higher oil prices and more structural long-term shifts. Saudi Arabia is set to host World Expo in 2030 and the FIFA World Cup in 2034, while it also continues work on megaprojects like the brand-new city Neom. Aside from driving infrastructure growth, we expect these projects to also drive social reform, partly to avoid the PR difficulties that Qatar had with regard to its hosting of the World Cup. While Saudi Arabia’s oil dependency can be seen as a weakness, it also provides a useful hedge when geopolitical tensions arise around the world. Saudi Arabia also has ambitious plans for decarbonising its own power production, targeting 50% of renewable power generation by 2030 vs around 1% today.

Latin America remains an investor darling and a clear beneficiary of falling rates. We think Mexico looks particularly good value, given the strong tailwinds from US nearshoring and the likelihood of falling interest rates. While the country will also elect a new president next year, the most important election will be in the US; clearly, a Donald Trump presidency would not be positive for Mexico. For some of the mid-cap growth companies we like in both Brazil and Mexico, a 200bps fall in interest rate costs could increase earnings by over 100% – something we don’t think the market is pricing in at the moment.

It would also be remiss not to mention Eastern Europe, partly as our two regional funds are some of the best performing equity funds available to the Swedish market over the last 12 months, returning 34%–36% in EUR. The results of Poland’s recent parliamentary elections, and subsequent expectations of improvements in the rule of law, mean that the country should receive another large tranche of EU funds (up to 1% of GDP in H2 2024). Meanwhile, Greece continues to go from strength to strength, thanks in part to a new ‘year-round’ tourist model. We therefore remain positive on these markets too.

Overall, frontier markets are in a better position than in previous years, with economic rebalancing processes beginning, or already advancing, in markets that have recently faced challenges such as Egypt, Pakistan and Nigeria. Indeed, equity markets have started to price in the improving dynamics, with a number of rallies taking place. Apart from these individual recovery cases, economies should remain resilient in fast-growing markets like Vietnam, the Philippines, Kazakhstan, the UAE, Bangladesh, Morocco and Romania, giving equity investors good reason to expect appealing returns.

What’s in the price?

The market-implied Fed rates shown in Figure 3 clearly demonstrate that much of the good news on rate cuts is already priced in. A look at valuations reinforces this idea, and really the only market that stands out as exceptionally inexpensive is China, as discussed above. We therefore believe that returns are more likely to be driven by earnings growth. Fortunately, earnings growth is expected to be strong across the emerging market universe next year, with Korea leading the pack at 68%.

Figure 11. Earnings growth and valuations in key markets

| Earnings growth (%. YoY) | P/E | 10 year average P/E | ||

| 2023 | 2024 | 2024 | ||

| Emerging markets | -4 | 18 | 11.4 | 11.4 |

| Frontier markets | 3 | 7 | 8.7 | 11.1 |

| S&P 500 | 1 | 11 | 18.9 | 17.1 |

| China-A | 12 | 19 | 11.6 | 12.5 |

| China | 14 | 15 | 9.4 | 10.8 |

| Korea | -34 | 68 | 10.7 | 9.8 |

| Taiwan | -19 | 18 | 15.3 | 13.6 |

| India | 23 | 14 | 19.3 | 17.0 |

| Vietnam | 8 | 22 | 9.3 | 12.6 |

| Kazakhstan | -14 | 17 | 6.3 | 6.0 |

Source: I/B/E/S, accessed 06.12.23

Unlike emerging markets, the US, on the whole, is trading well above historical averages. This is driven by the ‘magnificent seven’, which will be under a lot of pressure to continue delivering blockbuster earnings. With the consensus now expecting 30% earnings growth for the next 12 months from these names, any misses (potentially driven by weakening consumer sentiment) would be severely punished by the market.

Navigating stormy seas

Despite the reasons for optimism, we are aware that 2024 is unlikely to be plain sailing. Our core investment approach has not altered, although as we have moved through 2023 we have sharpened our view of what ‘company quality’ means in the new normal of capital scarcity and volatility.

When selecting companies, we place a strong emphasis on earnings visibility, strong balance sheets and the ability to defend margins. It is useful to ask the management teams of companies we meet: “How much visibility do you have on your earnings for next year?”. Surprisingly, the answer is often “very little”. For many companies we look at, sell-side earnings expectations are overly bullish, which could lead to disappointments and poor stock performance when earnings are invariably revised down.

Based on our core investment criteria, which include structural growth, reasonable valuation and having some area where we are different from the consensus, we believe we have built portfolios of companies that will perform strongly regardless of the economic backdrop, but especially if the risk appetite among global investors improves slightly, which is our base case.

Sustainability

Sustainable investing, too often misunderstood as climate investing, has remained under pressure in 2023, something of a predictable backlash after the enormous hype and overpromising in 2020–2021. One reason for this is the plunge in renewable stocks, with the popular solar index (Solactive) down 42% year-to-date. This has been driven by high interest rates and input costs (particularly in offshore wind) and massive overcapacity (the solar value chain in China).

For us, sustainability means much more than just investing in green energy companies (see our 2022 sustainability report for details). Understanding a company’s sustainability profile is just one part of our investment approach, and we would not invest in a ‘sustainable’ company if the fundamentals and valuations were not up to scratch.

It has been pleasing to note that the ‘ESG backlash’ has been largely contained to the US, and in our markets we have actually seen continuing improvements in ESG reporting and some harmonisation of standards. For example, whereas a few years ago less than 50% of our Global Emerging Markets Sustainable portfolio reported Scope 1 and 2 emissions, this is now around 75%, as per our latest Impact Report. This provides greater opportunity to meaningfully compare companies’ activities and their bold claims regarding sustainability.

More generally, we welcome the harmonisation of global reporting standards. Although the adoption is somewhat more complicated than we would like, we continue to look forward to the day when carbon intensity will be discussed and compared in the same way that dividend yields and P/E ratios are. The EU Corporate Sustainability Due Diligence Directive (EU CSDDD) will be a major driver in further improving disclosure and helping us quantify what the EU considers a ‘sustainable investment’.

We expect climate adaptation and physical risks will continue to rise up investors’ agendas in 2024, as will the natural environment (particularly deforestation) and human rights. These areas are more difficult to systematically assess than transition risks (risks related to transitioning to a lower-carbon economy), for which GHG emissions measurement and reporting is fairly well established. While there are various frameworks being introduced like the Taskforce on Nature-related Financial Disclosures (TNFD) and collaborative initiatives such as PRI-led Spring and Advance, for the time being this will require more heavy lifting and dialogue between investors and companies.

Conclusion

Despite the improving economic outlook and decent returns of late in most equity markets, emerging markets, and particularly China, remain much unloved. Given that emerging markets are trading at 11.4x P/E for 2024, with earnings growth at 18%, the risk-return profile for this asset class appears favourable. Moreover, it would not take much for the market to move if sentiment were to improve slightly – a phenomenon we have often experienced in our over 25 years of investing in emerging markets. This was evidenced by the breathtaking 60% rally in USD terms in China in just three months from November 2022 to January 2023, when the largest member of the EM index showed signs of economic recovery. Frontier and smaller emerging markets provided another noteworthy example of this trend this year. Few would have predicted that Pakistan, Sri Lanka, Egypt and Argentina would be among the best-performing markets in 2023, with USD returns ranging from 25% to 115%.

Nevertheless, it is difficult to see any significant catalysts in the short term, and it is likely that geopolitical noise could increase going into the US presidential election. However, if the real estate market continues to recover, we would expect sentiment to gradually improve, especially if the Fed starts cutting rates from Q2 as the market expects.

So, while we are not suggesting that investors ‘sell the house’ to invest in emerging and frontier markets, we do think it makes sense to have some allocation, particularly with such stretched valuations and high earnings expectations in the US. On top of high expected returns, frontier markets can also offer further diversification benefits due to low correlations among individual markets and with other asset classes.

Share

Documents & links

Share