Greece returns to investment grade after 13 years – what does this mean for equity investors?

On September 20th, S&P raised Greece’s sovereign debt rating to investment grade, with Fitch and Moody’s expected to follow. The upgrade marks a turning point for Greece. Greece was downgraded to junk 13 years ago and this upgrade is the result of significant improvement of the fiscal position and completion of much-needed structural reforms which have attracted ample investments and EU funds and have driven strong economic growth.

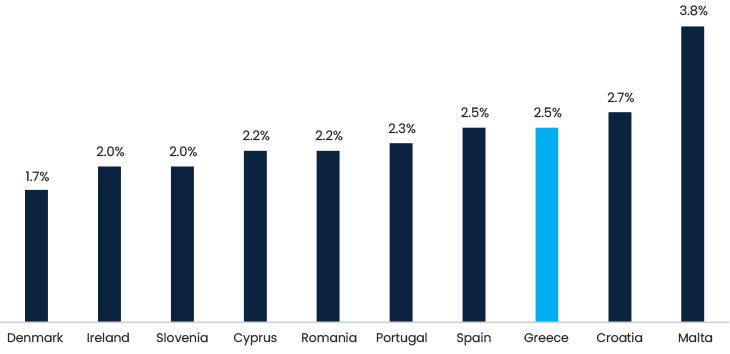

In fact, Greece is currently one of the best performing economies in the European Union (EU) and will enjoy the EU’s third highest GDP growth rate this year, according to the IMF, behind only Malta and Croatia. Given that this growth has been driven by structural reforms, the trend is likely to continue, particularly bolstered by investments, EU funds supporting the green transition as well as a strong revival in tourism.

Greece will have the third highest GDP growth rate in the EU, in 2023

Importantly, this growth has not come at the cost of fiscal discipline, and in 2022, Greece produced a primary surplus for the first time since the crisis, even if it was marginal at 0.1% of GDP, thanks in part to the host of measures implemented to curb tax evasion. In 2023, even including the reconstruction costs related to the devasting floods, the primary surplus is expected to be 0.7% of GDP.

Lower cost of capital = Higher valuations

The yield on Greece’s 10-year government bond had been higher than Italy’s for quite some time, but when investors began to appreciate Greece’s favorable debt structure and ambition to further consolidate debts, Greece’s yield dropped to 56 bps below Italy’s. The spread between the yield on Greece’s 10-year maturity bonds and Germany’s, which are rated with the highest safety, has declined meaningfully, more than 100 bps, since investment grade status started being priced into debt markets, just after the elections.

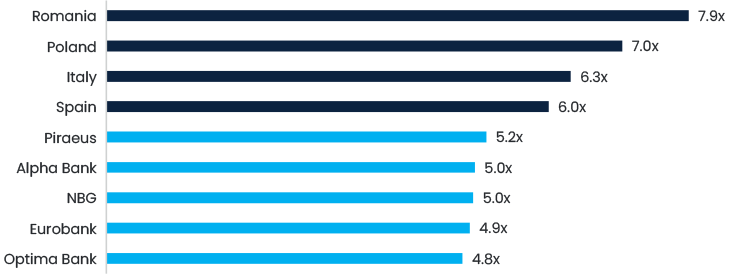

Equity markets have a strong inverse correlation with bond yields, and a decrease in the cost of debt can lift the entire equity market, with banks tending to be especially sensitive. In Greece, after the government’s successful fiscal consolidation, the market rallied +31% (USD) year-to-date, making it the highest returning emerging market in 2023 (so far). Even after the strong performance, the Greek banks are the cheapest among peers on price-to-earnings (P/E) ratios, highlighting that the equity markets have yet to fully internalize the positive developments.

Bank P/Es 2024

Injection of Capital Flows

The attainment of investment grade status also invites capital flows for assets across the board. The most obvious benefit will be that Greek sovereign debt instruments can enter international bond indices that are exclusive for investment grade bonds. This development may lead to capital inflows worth between EUR 6 to 10bn during 2024.

Additionally, for the equity market, this upgrade opens doors for many institutional investors, particularly in Asia, who restrict their investments to "investment grade" countries. While quantifying the exact impact on equity markets is challenging, it is a clearly positive that a broader pool of investors can now explore opportunities in Greece.

To market watchers, it has been obvious that a new class of investors has been looking at Greece. In the recent IPO of Optima Bank, large foreign institutional investors appeared as cornerstones and foreigners grabbed 41% of the IPO amount. East Capital also invested in Optima Bank, a “gem” of a bank, with a small EUR 530 million market cap, that aims to double its loan book by 2025, and is projected to have sector-beating ROEs of 26% this year. An even more important deal came fresh off the announcement of Greece’s investment grade rating. Unicredit announced its strategic partnership with Greece’s Alpha bank. The deal marks the first investment from a foreign strategic partner in the banking sector since before the crisis. It comes alongside a clear improvement in fundamentals and in the investment climate in Greece, thanks to the clean-up of the banking industry. Slowly and surely Greek banks have shed their label as "toxic assets" and become a destination for growth and long-term opportunities.

These deals are especially important for the government’s goal to completely privatise the four systematic banks, as the government prefers to sell its stakes to strategic partners in Europe.

Looking forward – developed market status and further inflows?

As Greece continues its reforms and achieves further milestones, it may ultimately regain its status as a developed market according to the MSCI. Although this reclassification is not expected before 2025, it appears to be an inevitable outcome. While there is a risk that Greece might lose its significant and visible position within the Emerging Europe market strategies, the upside is that the road towards reentering the developed equity markets might attract developed market managers with deeper pockets to rediscover Greece.

East Capital is positioned to capitalize on Greece’s journey to regain its developed market status, while it remains an emerging market. With Greece’s green transition investment opportunities, companies facilitating the renewable energy transition, clear-cut growth opportunities within the very attractively valued banks, lower costs of borrowing, larger investment flows and recovering Greek consumption, we see lots of things to be excited about in Greece.

Share

Share