Sustainability

Sustainability in the investment process

Since our start in 1997, we have strived to be long-term, active and responsible investors and owners. East Capital has been investing in emerging and frontier markets for 25 years. ESG analysis has been an integral part of our investment process from the beginning. Initially, this meant focusing on companies with owners with aligned incentives and transparent operations. This is still the case, but our ESG framework has developed over time.

All East Capital Group’s strategies follow an ESG framework. The framework consists of four pillars: Sector Exclusions (Negative Screening); Controversy (Norms-Based) Screening; Proprietary ESG Analysis; and Active Ownership. These four pillars are described in detail in our ESG Policy.

East Capital follows the Principles for Responsible Investment (PRI), the UN's guidelines for responsible investment. As an active owner, we take responsibility and work together with other investors and organisations to contribute to a more sustainable world.

Sustainability Related Information

The Sustainable Financial Disclosure Regulation (SFDR) is the EU regulation that aims to increase transparency on sustainability and sustainability risks in the financial market. Its purpose is to facilitate investors by standardising the reporting of sustainability factors (ESG factors).

Please see below for SFDR information on East Capital's funds.

The PDF-files below contain website disclosures that provide important information about the investment strategies and asset allocations Funds. We describe our methodologies for promoting environmental and social characteristics, in the case of the Article 8 Funds, and attaining the sustainable investment objective, in the case of the Article 9 Fund. We ensure that no investments cause significant harm and consider principal adverse impacts on sustainability factors in the investment process.

Additionally, we discuss our approaches to good governance practices and active ownership. We believe that good corporate governance, as well as environmentally and socially responsible behaviour, is essential in managing a company to maximise long-term shareholder value. Therefore, we must not only have a strong framework to measure sustainability indicators that assess the impact on environmental and social characteristics, but also maintain productive dialogues with our portfolio companies to ensure that they improve on material ESG aspects.

Our ESG approach combines proprietary tools, regularly updated by analysts and portfolio managers, with internal checks and cooperation with the ESG team, as well as data from external service providers. Proprietary tools are particularly important due to the lack of sustainability-related data from companies, especially in emerging and frontier markets. Our approach ensures that ESG considerations are integrated into the investment process.

Due to the specific circumstances, the East Capital Russia and East Capital Eastern Europe Sub-Funds can no longer promote environmental and social characteristics for all portfolio companies and meet the related reporting requirements under SFDR. Therefore, the Sub-Funds are currently planned to be reclassified under the disclosure regime of Article 6 of the SFDR. This regime applies to funds that do not promote environmental, social and governance (ESG) characteristics and do not have sustainable investments as their objective.

East Capital Balkans, China A-Shares, Global Frontier Markets, Multi-Strategi and New Europe are all classified as Article 8 Funds under Regulation (EU) 2019/2088 (the Sustainable Finance Disclosure Regulation, ‘the SFDR’). Although the Funds do not have a sustainable investment objective, they aim to promote environmental or social characteristics, or a combination of both, as long as the companies in which they invest follow good governance practices.

The Funds are committed to maintain proportion of sustainable investments with an environmental and/or a social objective. We have created a Three-Step-Test (“the Test”) to determine whether an investment qualifies as sustainable. The Test is based on the definition of a sustainable investment in Article 2(17) of the SFDR. We use several of our proprietary ESG tools in combination with data from external service providers, including our Red Flag Analysis, our ESG Scorecards, sector-based screening and norms-based screening).

The disclosure for each Fund can be found in the PDF-files below. Each disclosure starts with a summary.

SFDR Website Disclosure Article 8 - East Capital Balkans

SFDR Website Disclosure Article 8 - East Capital China A-Shares

SFDR Website Disclosure Article 8 - East Capital Global Frontier Markets

SFDR Website Disclosure Article 8 - East Capital Multi-Strategi

East Capital Global Emerging Markets Sustainable is classified as an Article 9 Fund under the SFDR. This means that alongside long-term capital growth, the Fund has a sustainable investment objective, which in the Fund’s case is defined as targeting positive contribution to the UN Sustainable Development Goals (SDGs) through exposure to companies in emerging markets. As such, the Fund’s holdings all drive positive SDG outcomes across their value chains as measured by our proprietary SDG Value Chain Assessment Tool (further described in the below PDF-file). The Fund is also committed to have a total minimum proportion of 90% sustainable investments with an environmental and/or a social objective (the only purpose of other investments is to hold necessary ancillary liquidity). We have developed a Three-Step-Test (“The Test”) to determine whether an investment should be considered as sustainable; the Test is based on the definition of a sustainable investment in Article 2(17) of the SFDR.

The disclosure for the Fund is accessible in the PDF-file and begins with a summary.

SFDR Website Disclosure Article 9 - East Capital Global Emerging Markets Sustainable

Statement on principal adverse impacts of investment decisions on sustainability factors.

The Principal Adverse Impact (PAI) statement is available on East Capital Group website.

East Capital proprietary ESG Scorecard

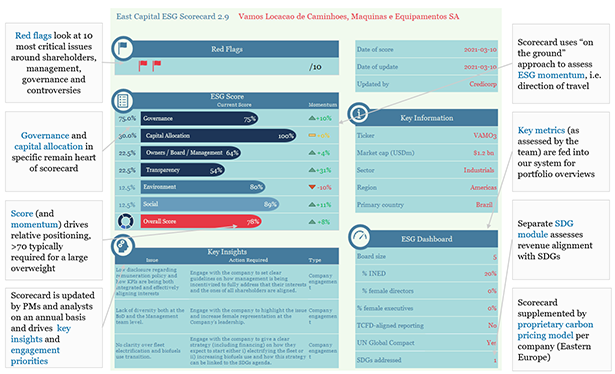

In 2016 we created and launched our own ESG Scorecard to better incorporate ESG factors into our investment process. We made this decision to formalise and structure our knowledge, experience and views of relevant and material ESG-related risks and opportunities. This was necessary due to lack of coverage of external ESG research on emerging and frontier markets. Since 2017, our ESG Scorecard includes a separate SDG module to ensure the integration of

risks and opportunities related to these goals on the path to 2030.

In 2020, we added a momentum score to guide our

engagement priorities.

The Scorecard guides our assessment of relevant and material ESG risks and opportunities from an emerging and frontier markets’ perspective. The relevant research analysts, portfolio managers and portfolio advisors fill in the scorecards with the support of our Chief Sustainability Officer. This process ensures that the entire investment team integrates relevant and material risks and opportunities in their fundamental analysis, resulting in a more holistic analysis of company quality. The ESG Scorecard includes 10 Red Flag questions and over 50 additional questions related to environmental, social and governance (ESG) factors. This structure allows for a thorough review of relevant and material ESG risks and opportunities, as well as an SDG module.

Collaborations

Since 2012, East Capital is a signatory to the PRI, Principles for Responsible Investment, the UN's responsible investment guidelines, which implement six principles relating to active ownership, ESG integration and disclosure. One Principle is to work together to improve our effectiveness in implementing the Principles.

We are also active members of other industry initiatives and organisations including ACGA, CDP, IFRS, Climate Action 100+, IIGCC, SISD, SWESIF and TCFD.

East Capital Group Sustainable Investment Report

East Capital Group has driven ESG-related issues in emerging and frontier markets for 25 years. We have applied unique insights and methods to our investments. Our 2022 Sustainable Investment Report, presents tools and outcome from across the group: Adrigo, East Capital, East Capital Real Estate and Espiria.