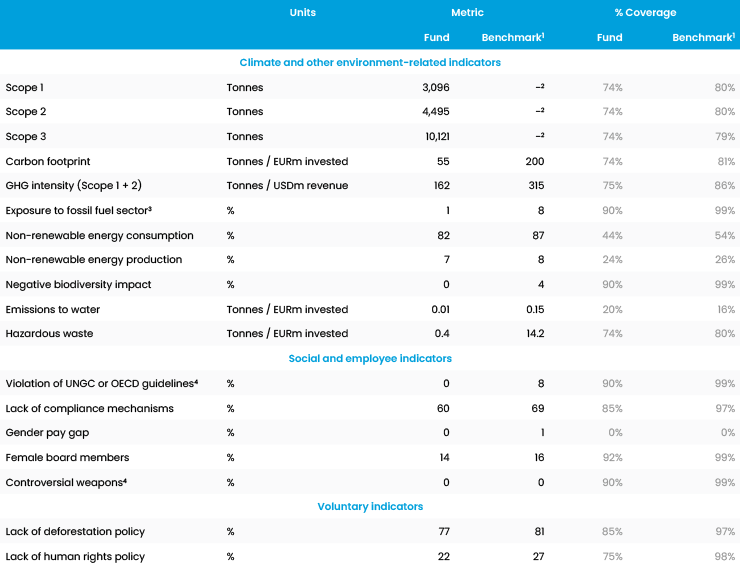

This report sets out the Principal Adverse Impact (“PAI”) indicators according to the EU’s Sustainable Finance Disclosure Regulation (“SFDR”). It then highlights the key metrics the portfolio management team uses to assess the impact of the fund’s investee companies on the surrounding world.

- Our fund’s GHG intensity is 49% below the benchmark; primarily because we do not invest in fossil fuel companies and because we do consider carbon intensity versus peers as part of the investment process. We would typically not invest in companies with a carbon intensity considerably above peers.

- Our fund‘s exposure to negative biodiversity impact / hazardous waste is nil / very low, we would not invest in such names according to our processes as we actively avoid misalignment with SDGs.

- Violation of global guidelines are part of our exclusion screening process.

- Due to lack of data on gender pay gap in emerging markets, we focus on board gender diversity. Our fund performs worse than the benchmark, partly due to our strong bias towards small and mid-caps names. This is a key engagement priority of ours.

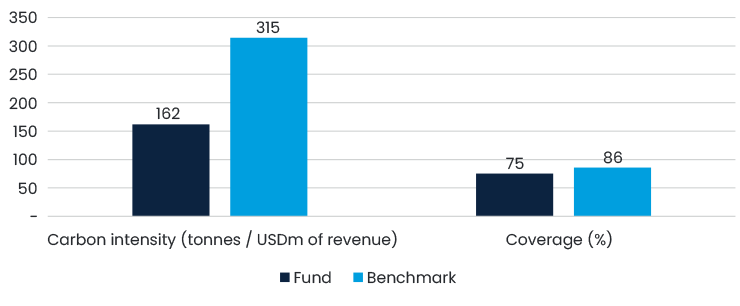

Carbon intensity versus benchmark

- Carbon intensity is one of the key metrics that we consider when assessing companies.

- Data coverage has been increasing, in part due to engagement efforts from investors like ourselves; for example, we actively participate every year in the CDP Non-Disclosure Campaign to improve climate related data in portfolio companies. Beyond disclosure efforts, we participate in Climate Action 100+ and Net Zero Engagement Initiative.

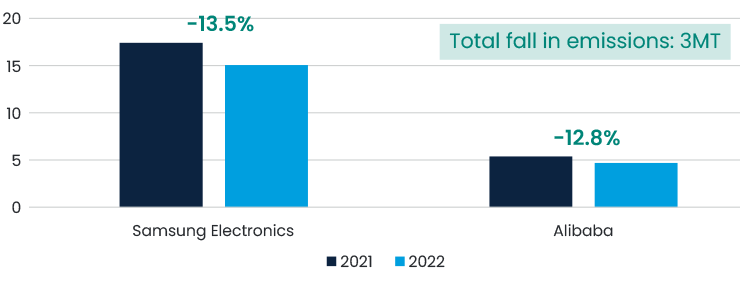

Case study: real world emissions reduction based on two large emitters

(absolute Scope 1 and 2 emissions, MT CO2e)

- When we analyse a company’s climate strategy, one key factor we look for is whether the company is demonstrating real-world fall in emissions, as “net zero” policies do not always imply this.

- For example, two of our largest holdings, Samsung and Alibaba reduced their emissions by 3 MT (this is equivalent to 6% of Sweden’s total emissions).

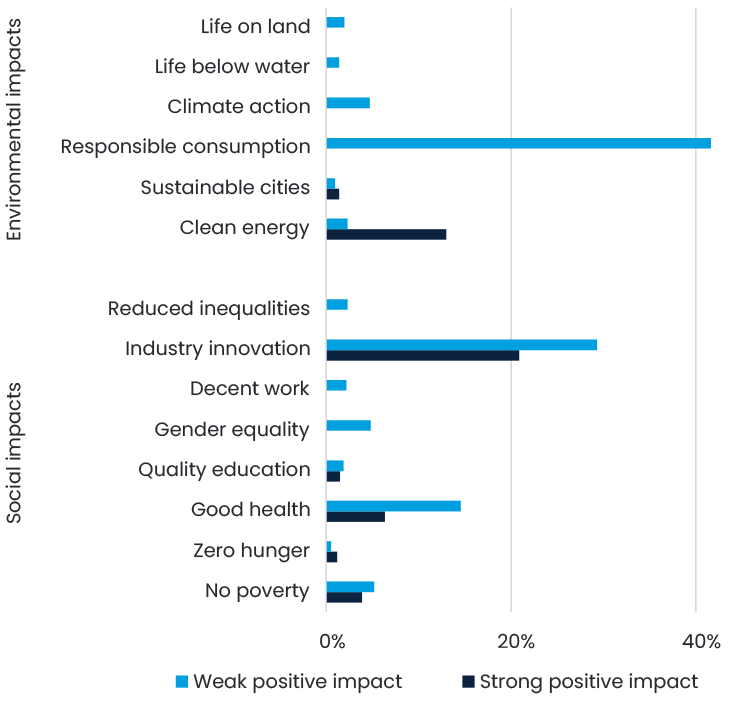

SDG Impact

- We assess SDG impact using a proprietary tool, which is explained in detail in a PRI case study and was recently selected as a best practice responsible investment example for China.

- East Capital SDG VCA (value chain analysis) combines revenue exposure and SASB mapping to identify the two most material SDGs for a company’s value chain. The tool gives a score of -100 to 100, based on current impact and 3-5 year outlook. Impact is assessed based on materiality, intentionality, additionality and criticality.

- We currently assess that 47% of the fund has a strong positive impact on one or more SDGs. Because we require a score of above 25 (“weak positive impact”) to be included in the portfolio, 100% of our companies have a positive impact on one SDG.

Case studies

Sustainable cities

Empower, the world’s largest district cooling company. District cooling is 50% more energy efficient than air conditioning, crucial in UAE where A/C accounts for 70% of overall GHG emissions.

Clean energy

Renew, India’s largest renewable energy company by total energy generation capacity, with a total portfolio of 13.7 GW as of Q2 2023, around 11% of India’s total renewable capacity (excluding hydro).

Industry and innovation

Sungrow, one of the world’s largest inverter companies, provides a key input for the solar value chain, and makes significant steps to decarbonise its own operations, achieving 45% renewable power usage in 2022, and targeting 100% by 2028.

Good health

Oncosclinicas, Brazil’s leading cancer clinics and labs chain, uses partnerships with first tier US institutions to bring latest treatments to Brazil.

No poverty

Gentera is the leading microfinance institution in Mexico and Peru and provides financial services to the underserved segment in the region. They have been the gateway for more than 13m people to the financial system.

Stewardship

We have voted at 100% of the 57 shareholder meetings where we have been able to vote; we have voted against 5.6% (or 25) of the items.

We voted against items that are not aligned with our voting policy, such as insufficient gender diversity at board level or overly long auditor tenure.

Voting is least we can do in terms of exercising our shareholder rights, and we typically follow up with management when we vote against items to ensure they understand the rationale for our actions.

Engagement Case Study

| Company | Vamos, a Brazilian logistics company. |

| Issue | The company was, at the time, one of only seven companies in our portfolio with an all male board. |

| Action | Raised issue in in-person meetings with the CFO in San Paolo in February 2023 and with the main shareholder in London in April 2023. |

| Result | Despite lukewarm response from the company initially, the company managed to find a strong female candidate for the June 2023 AGM, who was appointed in July 2023. |

We select engagement objectives based on a combination of materiality and efficacy (i.e., whether we have a realistic prospect of bringing about change).

Sustainable Investment Definition

ESG analysis at East Capital is done by the Portfolio Managers and Analysts who cover the companies using robust proprietary tools, such as East Capital ESG scorecard and East Capital SDG VCA.

We classify “sustainable investment" using 3 binding elements that leverage the results of these proprietary tools. These elements are outlined to the right.

Currently we assess that 97% of the fund can be classified as sustainable. There is one company that does not meet our criteria, due to a low corporate governance score; this holding however meets the minimum safeguards to the extent that it is not in an excluded sector (as per Step 1. I of our three binding elements) and has a good track record of managing environmental and social issues, with no significant controversies (Step 1. II). We also hold a small amount of cash for liquidity purposes, which also cannot be classified as a sustainable investment.

-

Sector based and norms-based screening

I. Companies with >5% of their revenues from fossil fuels, weapons, tobacco, gambling, pornography and alcohol;

II. We also use a third-party provider to check for breaches of UN Global Compact. -

SDG VCA tool of at least 25

I. This ensures companies have a net positive impact on the SDGs. -

Company is classified as sustainable as per our “three step test”

I. Contribution to E and/or S >60% score in E&S section of ESG scorecard. II. No significant harm to E or S No red flags related to E&S issues and compliance in screening. III. Good governance practices >60% in G section of ESG scorecard and no more than 2 red flags related to G.

1 MSCI Emerging Markets Index. No specific index has been designated as a reference benchmark for the purpose of attaining environmental or social objectives.

2 We do not report data for the benchmark because this is an absolute measure that is related to the size of the fund, i.e. owning 1% of a company with 100 tonnes of Scope 1 emissions would result in 1 tonne of Scope 1 emissions attributable to the fund.

3 We understand this relates to a port management company which we believe has been erroneously included by the data provider.

4 While coverage by the data provider is below 100%, our investment and screening processes imply full portfolio coverage on this parameter.