While the world’s investors are focused on Nvidia and a few other obvious AI plays, we have been looking across the value chain to see how we can gain exposure in emerging markets. One misconception is that advanced chips are the biggest bottleneck in AI development, when in fact, as Elon Musk recently pointed out1, it's actually electrical transformers - and in the next few years it will be overall electricity supply. That’s why we’ve spent a lot of time this year digging into the electricity value chain, especially transformers. We invest in two of the largest transformer producers in Asia, Korea’s Hyundai Electric and Taiwan’s Fortune Electric. These companies make a significant amount of their revenues from exports, for example 50% of Hyundai’s total orders came from the US or Middle East in 2023.

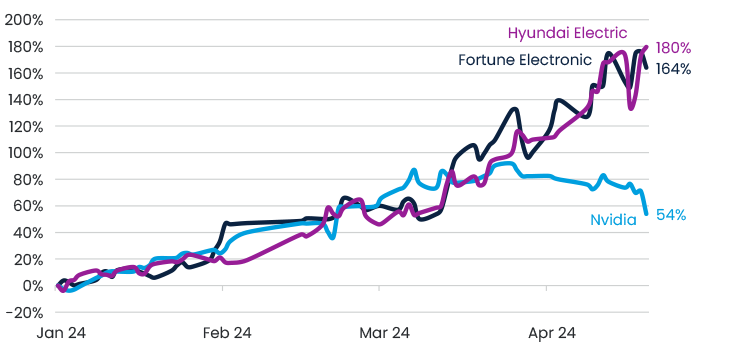

Total return of various AI names YTD (USD)

A recent study by the International Energy Agency (IEA)2 estimates that data centre electricity consumption could double by 2026, from 460 terawatt hours (TWh) in 2022 to more than 1,000 TWh in 2026. This demand is roughly equivalent to the electricity consumption of Japan. Of the more than 8,000 data centres currently in operation globally, 33% of these are located in the United States, 16% in Europe, and close to 10% in China.

For the time being, one of the key bottlenecks in the development of these centres is a shortage of transformers, which “step-up” or “step-down” power and allow it to be transported across the high voltage transmission lines. A recent study in the US3 found that utility companies are experiencing extended lead times for transformers of up to two years (a fourfold increase compared to lead times prior to 2022) and are reporting price increases of as much as four to nine times over the past 3 years. The main reason for this is a boom in demand, driven by data centres and renewable projects, though there are a raft of other factors, including rising input prices, pandemic-related shortages and backlogs, labour constraints, shipping issues and geopolitical tensions, i.e. a reluctance to buy from China.

In our emerging markets fund, the two companies we invest in were somewhat forgotten over the last few years and are not well covered by sell-side brokers, though they have performed very strongly over the last year. Fortune Electric is the leading electrical equipment manufacturer in Taiwan, representing 75% of total Taiwanese transformer exports in 2022. Q1 2024 revenue grew 97% YoY, and we expect that sales and earnings will grow at 48%/107% CAGR from 2023-2025. Hyundai Electric is the leading player in Korea, with 66% of its 2023 sales coming from overseas.

While neither of these companies look optically “cheap” – for example Hyundai is 16x EBITDA for 2025 and Fortune Electric is 27x EBITDA, we believe that sell-side is significantly underestimating earnings growth. For example, Hyundai Electric published Q1 2024 results today that demonstrated operating profit growth of 178% YoY, 51% above consensus. As such, we think the 37% YoY EBITDA growth expected by consensus for 2024 will be revised much higher, which is typically a strong driver of stock performance. As such, we believe that these names still remain solid exposures to the ongoing boom in demand for electricity powered by data centres and renewables.