Poland's golden age of growth

During the global economic slow-down, Poland stands out as a European growth champion. With its uninterrupted pace of high growth averaging 4.2% p.a. between 1992-2019, Poland is steadily catching up with Western Europe and has become the seventh largest economy in the EU with a total GDP of EUR 524 billion. Considering its 38 million population, with a turbulent history and post-EU entry emigration bleed, we think that Poland’s remarkable growth engine is not receiving the attention it deserves.

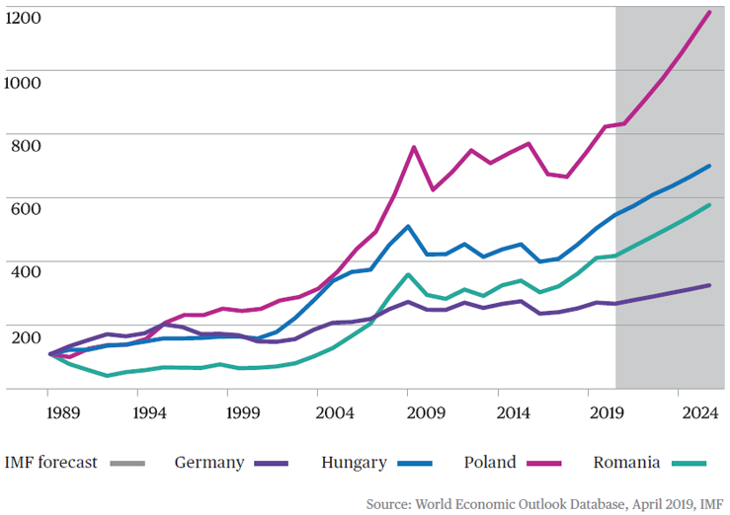

The strength and resilience of the Polish economy can be attributed to its large domestic market, early and deep economic reforms and prudent policies, with consistent EU strategy being the top priority, serving as an important discipline for political and economic integration. A vibrant entrepreneurial landscape of small and mid-sized enterprises benefiting from both a large domestic market and strong competitive advantages in neighbouring European countries is also an important source of growth. Large inflows of immigrants from Ukraine and CIS countries have supported the labour market, exports’competitiveness, the real estate market and domestic consumption. Poland’s resilience was proven during the financial crisis of 2008/09 when it was the only EU country to avoid recession. Since 1989, Poland has increased its GDP per capita almost eightfold to USD 15,431, while in Hungary it grew by 4.5x, in Romania by 4.3x and in Germany by almost 2x. Even today, Poland is consistently outperforming its peers with a GDP growth rate comfortably above 4% or even 5%.

Growth of GDP per capita (current prices, USD) (1989=100)

Strong domestic consumption

One of the most important features of the Polish economy is its large domestic consumer market comprising 61% of GDP, exceeding the EU average, and in this respect more reminiscent of the U.S. In fact, household consumption, driven by a strong labour market and wage growth of more than 5%, is expected to continue being one of the main drivers of the Polish economy in the mid-term. The government’s policy of massive increases in social transfers is fuelling this growth even further. Family 500+, an important government programme introduced in 2016, has added about 2-3% to disposable income per year. In 2019, a new wave of social payments was announced including an extension of the Family 500 +, amounting to 1.7% of GDP and expected to boost consumption by over 3% in 2020. Just by extending the Family 500+ programme, a family with two children and average net salaries of 864 EUR per earner, will see their incomes rising by an additional 7% per month.

Moreover, young people under the age of 26 will not pay income taxes, pensioners will see rising pensions and the general population will pay lower income taxes by 1%. Importantly, these transfers do not jeopardize the country’s solid fiscal position with the budget deficit at less than 2% of GDP. These policies are clearly positive for consumption, and the retail, real estate, leisure, healthcare and education sectors. For example, even this year we are seeing YTD retail trade growth in Poland averaging 7% with potential to accelerate further in 2H 2019 and 2020. As an investor, what we like even more is the e-commerce part of consumption, growing by 15% between 2008-2018. For example, we have seen the asset-light e-commerce platforms of the largest internet company in the country, Wirtualna Polska, growing by over 20% in 2018 and YTD, while the largest in CEE online shoe retailer has grown by 56% YTD.

Infrastructure spending

In terms of infrastructure investments, Poland has been the biggest beneficiary of EU funds in 2007-2013 and 2014-2020e, with EUR 102bn and EUR 106bn of funds received and to be received respectively for each period. We expect Poland in the future to continue receiving net EU funds at a pace of around 0.8% of GDP per year even beyond 2020. The construction and real estate sectors are booming, driven by infrastructure projects as well as growing business activities and expansion of global service centres in Poland with international companies such as IBM, Citi Group, Credit Swiss, Capgemini relocating part of their operations to Poland. Yields in the real estate sector have declined to a record low of 5% and we see increasing sizes of deals for business office skyscrapers reaching EUR 400-600m with yields at or even below 5%, which are approaching Western European levels. Several real estate companies listed on the Warsaw Stock Exchange are benefitting from these opportunities and show increasing high double-digit dividend yields and rising rental revenues.

The new economy

Poland also managed to find robust innovative sources of growth in the ‘New economy’. One of the fastest growing sectors is video games development. The success of CD Projekt, now a company with a market capitalization of over EUR 5bn surging almost ten-fold over the last 3 years, triggered an impressive growth in the number of video game developers in the country. Currently there are over 300 game developing companies operating in Poland and over 20 are listed on the Warsaw Stock Exchange and NewConnect, the alternative stock exchange in Warsaw for mid and small-caps.

Risks to growth

What are the risks to this Polish growth story? The most widely cited sources of economic headwinds include deteriorating demographics, an ageing population and emigration. Nevertheless, since 2014 around 1.0-1.3 million Ukrainians arrived in Poland to work, and together with the inflow from CIS countries, the number of immigrants has reached 2 million, remarkably the highest immigration inflow in absolute numbers for any EU country. According to the estimates of the National Bank of Poland, Ukrainian immigrants have a positive impact on GDP of 0.3-0.9% per year.

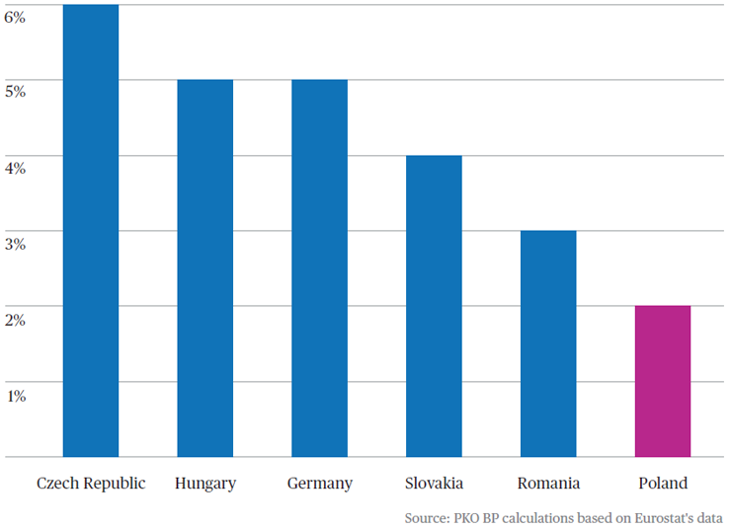

In terms of external risks, exports to Germany and the EU could be under pressure amid escalating trade wars and a Eurozone slowdown. However, it is important to note that despite its proximity, Poland is less susceptible to German slow-down than its CEE peers. For example, the share of the automotive sector in the value added of Polish GDP is below 2% vs. 5.5% in the Czech Republic, 5.2% in Hungary or 4.7% in Germany.

Share of automotive sector in value added created in selected economies in the region

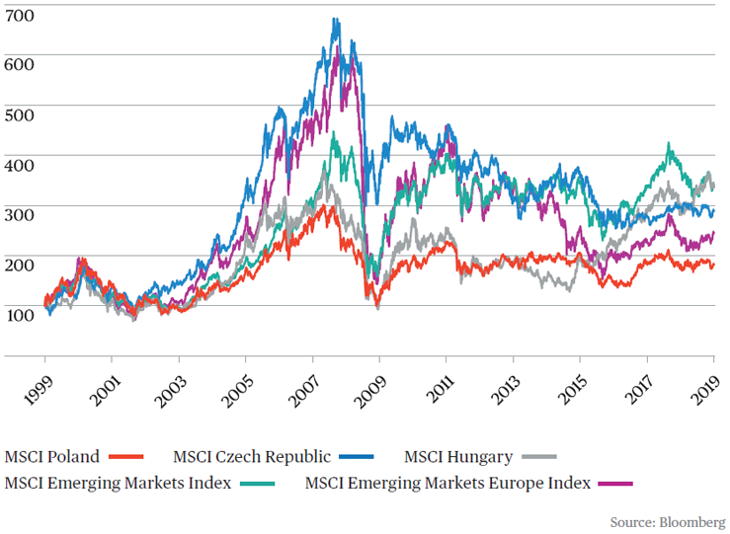

Sluggish performance in equities

Observing this unprecedented Polish economic boom, a natural question arises – why has the Polish equity market not always followed the positive economic developments in the country? During the last 20 years, the Polish MSCI index was up 123% vs. the Emerging Europe index up by 210% and YTD Poland has underperformed this index by almost 18%.

Firstly, it can be partially explained by the structure of the Polish equity market, where the largest blue-chips are State Owned Enterprises (SOEs) and banks. Many Polish policy changes have supported the macroeconomy and consumption, but not SOEs per se, where corporate governance standards and shareholders’ returns have been sub-par. Banks, comprising over 50% of Polish blue-chip market capitalization, also saw multiple headwinds including a banking tax introduced in 2016 that put the profitability of the sector under pressure. It all resulted in banking dividend yields dropping from 4.7% in 2011 to 1.7% in 2017, causing their equity prices to underperform. As part of our ESG efforts in the region, we started to address these challenges by engaging with the Polish SOEs, trying to improve their corporate governance and boards.

Secondly, the Polish market has also been suffering from equity outflows from domestic investors due to an overhaul of the second pillar pension system as well as some isolated scandals in the mutual fund industry. International flows have been affected by the reduced weight of Poland in MSCI Emerging Markets index from 1.75% in August 2009 to 1.09% in May 2019. Going forward we see this trend reversing as the government has approved the launch of a new private pension system, resembling that of the United Kingdom, with long-term inflows to domestic equities expected to reach up to 2bn EUR annually – similar levels of flows experienced during the best years of the second pillar pension funds’ investments in 2007-2013. During those years, valuations of Polish equities were among the highest in Emerging Markets, reaching 13-14x earnings.

Considering the structure of the Polish market, and our strategy to be index agnostic and focus our investments on the fast-growing part of the economy, our long-term positioning has been to be underweight in Polish SOEs and banks, which inevitably gave us a significant country underweight. We are finding attractive exposure to real economic growth through our overweight in mid-caps, consumer names and innovative growth companies with a digital presence. We also substitute banking exposure through our investments in foreign banks active in the region, i.e. Austrian banks. As investors we must stay pragmatic and smartly navigate the threats and opportunities amid changing political environments and policies.

Currently, Polish equity valuations are at the lowest level in seven years, around 10x price earnings. Together with a solid EPS growth of 8.7% forecasted between 2018 and 20211 and potential for an improving dividend yield from the current 2.5% to above 4%, the Polish market offers an attractive proposition to investors. While we might be close to the peak of the macro cycle, sharp deceleration of the economy is unlikely due to the strong domestic growth drivers in place. The timing might be right for investors to finally capitalize on what the World Bank, in untypically ornate rhetoric, has termed the Polish “golden age” of growth.

1According to the Bloomberg consensus.