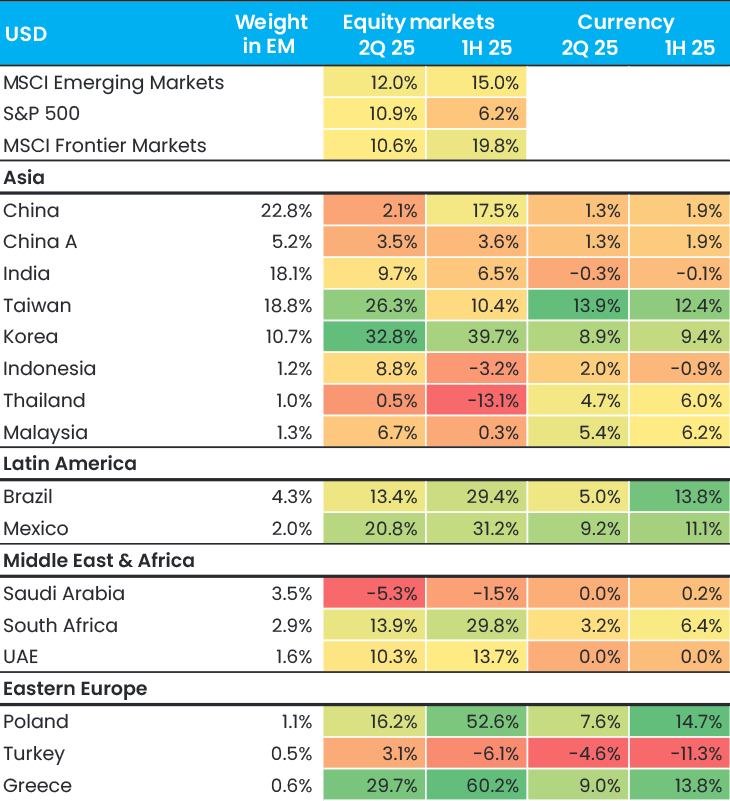

Q2 was exceptionally strong for both emerging and frontier markets, which returned 12.0% and 10.6% respectively. Emerging markets outperformed the S&P 500’s 10.9% return, while frontier markets kept pace. Looking at the first half of the year, emerging markets outperformed the S&P 500 for the first time since 2017, posting staggering returns of 14.9% compared to just 6.2% for the S&P 500. Frontier markets performed even better, returning 19.8%.

Figure 1. Markets performance Q2 2025 (USD)

These figures are particularly striking given the barrage of negative headlines surrounding global trade, geopolitical tensions, and political dynamics in many countries. To some extent, this performance can be explained by a rebound from the second half of 2024, when markets fell from their pre-US election peaks. For example, the emerging market index fell by 12.6% between early October 2024 and the end of the year.

The reason for the rebound is that despite the seemingly worst-case tariff announcements on Liberation Day on 2 April, President Trump’s bark has so far appeared worse than his bite. The “invisible hand” of the markets intervened, and the sharp rise in US bond yields forced the US administration to delay the tariffs by 90 days, until 9 July. President Trump has announced a few deals so far, for example with the UK and Vietnam, and he has maintained that he will not grant an extension. However, we wonder whether this will be the case. Naturally, we and all other investors will be watching the headlines closely until then.

China was the worst hit country, though we have already seen tariffs come down significantly, approaching 32% on a weighted basis. There is scope for further reductions, particularly given China’s underappreciated leverage when it comes to rare earths, where they controlled 61% of mining and 91% of refining (and hence sales) in 2024. Following the tariff announcements, China’s decision to limit exports of rare earths had a real impact on the auto supply chains in the US, with Ford reportedly shutting one of its factories for a week due to a lack of rare earth magnets.

Markets move when reality differs from expectations, as can certainly be seen in FX markets, where most currencies have significantly appreciated against the USD in the second quarter and the first half of the year. This is partly because the level of “policy uncertainty” (a polite term for chaos) in the US was probably greater than anyone expected, and the recently passed “Big Beautiful Bill” will only increase the ballooning deficit in the US, which is negative for the USD.

Focusing on Q2, Taiwan and Korea were the largest drivers of emerging markets, with returns of 26.3% and 32.8% respectively. Taiwan experienced stunning currency appreciation of 13.9%, as foreign investors piled into local shares and exporters decreased their USD holdings. Key exporters such as TSMC hedge their currency exposure, thereby reducing the impact on margins. TSMC’s results continued to improve, with April 2025 revenue growing 48% year-on-year, partly due to pre-buying before tariffs were implemented.

The Korean market was driven by anticipation of, and subsequent election of, a government more friendly to business, and to cryptocurrency and AI. As a result, the Korean index had its strongest performance in 26 years.

Frontier markets were strong across the board, with even the Middle East (included in our fund Global Frontier Markets ) proving resilient, despite some intra-quarter volatility, with the UAE market returning 12% in Q2. The standout markets were in Africa, where our Nigerian banks, Guaranty Trust and Zenith Bank, both increased by around 30% during the quarter, adding significant alpha. Despite their substantial re-rating so far in 2025, these banks still only trade at 2-2.5x P/E, offering an attractive risk-reward profile.

We would be remiss not to mention the strong performance of our Emerging European strategies, with our Balkans Fund returning 19.3% in the quarter and our New Europe fund returning 16.1%. Year-to-date, these funds are up an impressive 29.6% and 34.7% respectively. This is due to our robust stock-picking, combined with the strong performance of countries such as Poland and Greece – markets that have rallied on renewed interest in Europe from global investors, as well as on their strong underlying fundamentals and previously underappreciated economic growth.

As usual, it was a busy quarter for travel. We had a successful trip to Brazil, where the local sentiment was the best that we have seen in a long time. The general view is that the rate-hiking cycle, which was necessitated by inflationary fiscal policies, has now come to an end, creating significant upside potential ahead of next year’s presidential election. The current favourite candidate is market-friendly Tarcísio de Freitas, governor of São Paulo. Our fund-specific quarterly comments provide more detail on other interesting trips and meetings, such as the Prosus investor day.

Looking ahead, we believe that emerging and frontier markets remain in a sweet spot, thanks to a softening dollar, falling oil prices and inflation, and a Fed that appears to be notably more dovish. Moreover, we are witnessing global investors beginning to question their substantial exposure to US equities, and consequently their USD-denominated revenue streams. Despite these concerns, positioning in emerging and frontier markets remains light, particularly in the US, where the majority of assets are based.

We published an article entitled The Return of Emerging Markets?, in which we outline the main drivers for this asset class. In short, we argue that, over a decade of underperformance has left emerging markets much more reasonably priced than the US, despite the former having much better growth prospects and clear macroeconomic triggers, such as falling inflation and interest rate cuts. We acknowledge that sustained rallies will require a more robust recovery in the Chinese economy, which we have yet to observe. Nevertheless, there are some tentative positive signs, such as rising real estate prices in Tier 1 cities like Beijing and Shanghai. In general, we believe that innovation is gradually shifting towards emerging markets - ranging from cutting-edge chip manufacturing in Taiwan to electric vehicles and battery technology in China. While this is not yet reflected in valuations, it is vitally important for investors concerned about the future.

Performance in USD net of fees.

This is marketing communication. This publication is not directed at you if we are prohibited by any law in any jurisdiction from making this information available to you and is not intended for any use that would be contrary to local laws or regulations. Every effort has been made to ensure the accuracy of the information, but it may be based on unaudited or unverified figures or sources. The information in this document should not be considered investment advice and should not be used as the sole basis for an investment decision. Please read the Prospectus and the KID, which are available on the fund pages at www.eastcapital.com