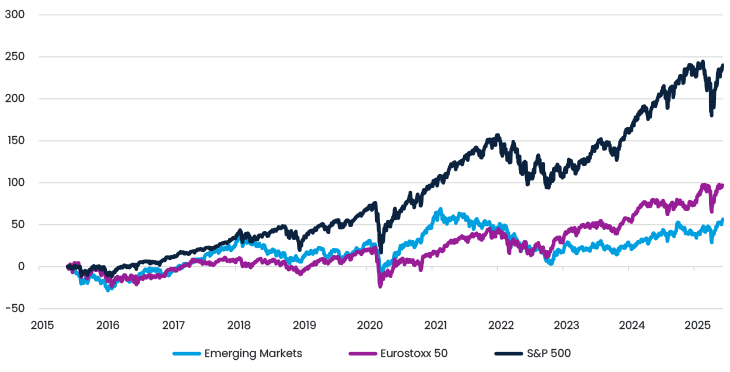

Over the past ten years, emerging markets have massively underperformed developed markets - the S&P 500 is up 238%, Eurostoxx50 up 114%, while the MSCI Emerging Markets is up just 57%. Investors have recently begun to question their large allocations to US equities and the US dollar. This shift can be seen in 2025 year-to-date performance numbers, with Europe +25%, emerging markets +13% and the S&P 500 at only +3%.

Figure 1. Total return over last 10 years (USD)

What are investors looking for?

Most equity investors aim to find companies that grow over time. This growth has clearly contributed to - and helps explain - the strong performance of the US market over the past 10 years. The US market is still expected to demonstrate earnings growth, albeit at a lower pace.

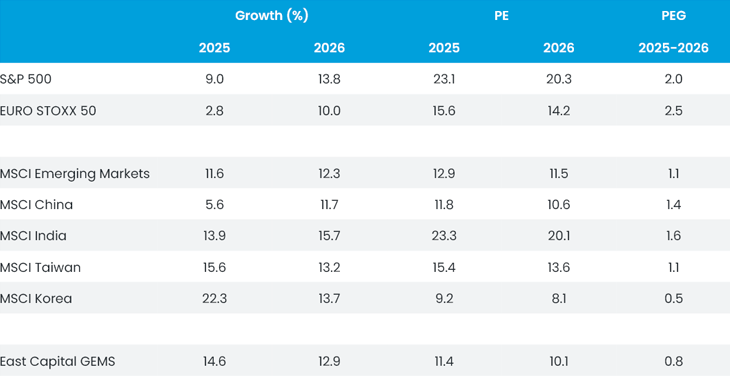

For example, the S&P 500 is projected to achieve an average earnings growth of 11.4% in 2025 and 2026 (Figure 2). While this remains a decent level of growth, given the slowdown in the US economy, investors will need to decide what constitutes an appropriate valuation level for this type of growth. The S&P 500 trades at 23.1x earnings for 2025, implying a PEG ratio of 2.0x. Typically, a PEG ratio below 1x is considered an attractive valuation relative to growth. Most investors are aware that the European market is not growing significantly, with average earnings growth projected at 6.3% for 2025 and 2026. While the valuation is lower than that of the US, at 15.6x 2025 earnings, the PEG ratio stands at 2.5x, which is somewhat less favourable than that of the US.

The situation in emerging markets is somewhat different – valuations are lower and growth is higher. Emerging markets trade at an average of 12.9x earnings, with an average earnings growth of 11.9% - i.e. a PEG ratio of 1.1x. This simply represents a much more attractive picture in terms of growth and valuation.

Figure 2. Price-to-earnings growth (PEG) ratios for key markets, 2025 and 2026

A de-escalation in trade wars?

While we cannot know how geopolitical and trade tensions will be resolved, it does appear markets are more confident that a solution can be reached. If so, perhaps investors will simply consider where they can find the most attractive combination of growth and valuation - in other words, the lowest PEG ratio. Emerging markets clearly appear to be the most attractive asset class, with a PEG of 1.1x. The East Capital Global Emerging Markets Sustainable fund has a PEG of 0.8x - significantly more attractive, due to holdings that are on average cheaper than the index (11.4x earnings) and offer higher growth at 13.7%.

What does the longer-term picture look like?

Many equity investors are looking for long-term growth, which can be achieved by investing in either companies that are expected to demonstrate consistent growth or markets with strong GDP growth. In recent years, the obvious choice for investors has been the “Magnificent Seven”. However, given the concentration and high valuations of these companies, investors may start to look elsewhere.

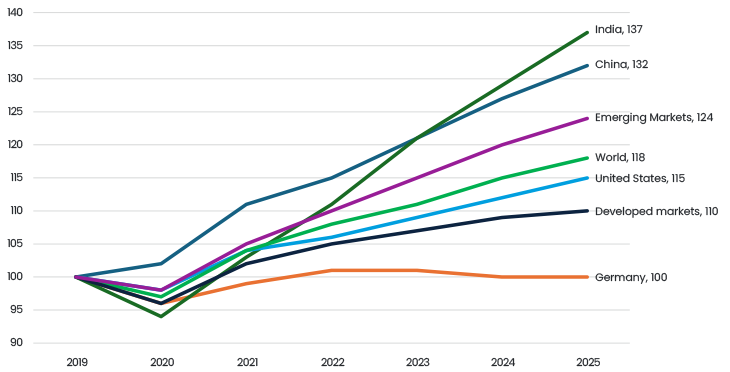

Taking a look at economic growth since the start of the pandemic (Figure 3), the IMF estimates that India will have grown its GDP by 37%, and China by 32%, by the end of 2025. In contrast, the US is expected to grow by just 15% and Germany by 0%.

Figure 3. Economic growth since 2019

Emerging markets are expected to grow at an average rate of 4.0% per year over the next five years, compared to 1.7% for developed markets. India is expected to become the world’s fourth-largest economy this year, and the third-largest country by 2028.

The US dollar is likely to stay soft

A weaker dollar naturally benefits emerging markets, not least because, historically, there has been a strong inverse relationship between dollar strength and emerging market outperformance. Psychologically, this remains highly significant for investors. This has traditionally been due to high levels of US dollar debt in emerging markets. However, this is no longer really the case; indebtedness is now more of a problem for developed economies. According to the IMF, gross state debt was 110% of GDP in developed economies versus 74% in emerging markets in 2025.

Put simply, a weakening dollar improves hard currency returns for foreign investors. For example, 12% of the 25% US dollar return that investors have received in Brazil this year is attributable to a strengthening currency. However, it also reduces inflationary pressures as imports become cheaper. This means there is less pressure on central banks to maintain high real interest rates in order to defend their currencies.

Going forward, policy uncertainty in the US, interest rate cuts and a reduction of strong financial inflows should mean the US dollar will remain relatively weak. This would be a significant tailwind for emerging markets.

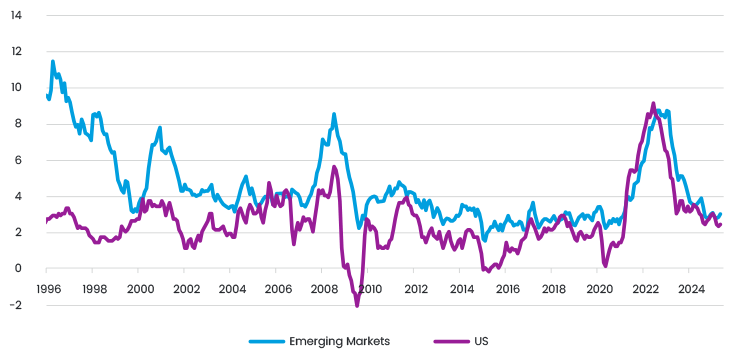

Inflation is no longer an issue in (most) emerging markets

In addition to a weaker US dollar, low oil prices, strong agricultural harvests and prudent macroeconomic policies have driven inflation to historically low levels in many emerging markets (see Figure 4). For instance, India’s inflation rate has fallen to 2.8%, a 75-month low. China stands as something of an outlier, with 0.1% deflation reflecting underlying economic softness rather than the aforementioned drivers.

That said, we expect these disinflationary trends to persist, although oil prices remain susceptible to geopolitical shocks. As a result, inflation is likely to continue its downward trajectory. This creates further scope for central banks to cut rates, often more aggressively than initially anticipated at the start of the year. With real interest rates still elevated on an ex-post basis, there remains ample room for monetary easing.

Figure 4. Median Inflation in Emerging Markets

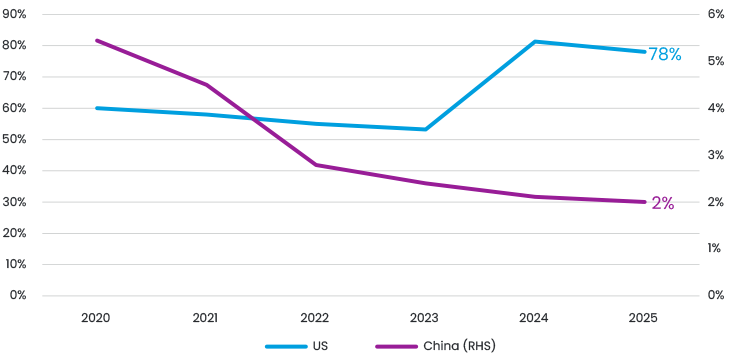

Very low allocations…

Emerging markets account for just over 10% of the weighting of global equity markets in the MSCI All Country World Index. However, most US investors allocate only 3-5% of their equity portfolios to this asset class. As illustrated in Figure 5, China’s representation in global equity funds has declined to just 2%, down from over 5% in 2020, while exposure to the US is hovering near record highs. This divergence is particularly striking given the underlying economic fundamentals: the US accounts for 27% of global GDP, while China contributes 17%.

Figure 5. Weight of US and China in global active equity funds since 2020

Is China turning the corner?

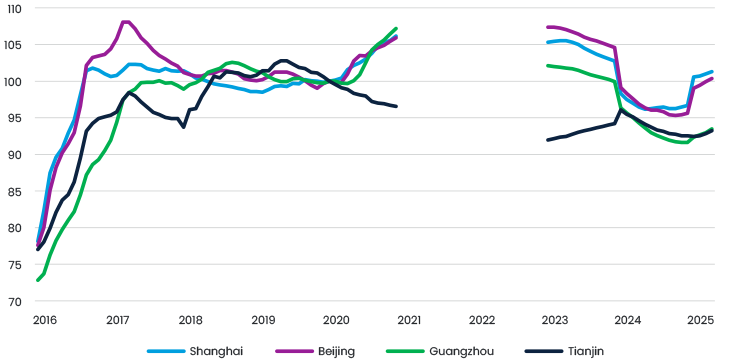

A sustained recovery in emerging markets would be difficult to envisage without some degree of stabilisation, or ideally improvement, in the Chinese economy. While China has yet to fully turn the corner, there are some tentative signs of progress, such as stabilising property prices in Tier-1 cities (Figure 6).

Now that tariff tensions have eased considerably, we anticipate that China will continue to introduce incremental, targeted policy support, though not on a large scale. These measures should gradually help guide the economy onto a more stable trajectory.

As such, we expect China to exit 2025 in a stronger position than when it entered, although any recovery is likely to be gradual rather than dramatic.

Figure 6. Chinese second-hand real estate prices (Jan 2020 = 100)

Investing in the future

The Western world has long dominated global innovation - from chips to planes and cars. However, gradually we are seeing a shift towards greater innovation and advanced manufacturing in China. Perhaps the most obvious example of this is BYD, which overtook Tesla in electric vehicle (EV) sales in the first quarter of this year. While it is probably true that Western engineers are more creative, China simply wins on numbers, with 50 out of the top 100 engineering universities located there. BYD employs 120 000 engineers, many of whom are competing with CATL’s 25 000 engineers to produce the world’s best batteries. Both companies have recently announced EV batteries that can be charged in just five minutes.

BYD is targeting 5.5 million car sales in 2025, and sold more pure EVs in Europe than Tesla in April 2025. They expect overall sales will reach 10 million in the long run, which would make it the world’s second-largest automaker after Toyota. Currently, there are 120 car brands in China, but probably only a quarter or less will still exist in ten years. This brutal competition means that only the strong players will survive and become competitive globally. The cheapest EV in China today costs around EUR 8 000. Currently, EVs account for more than half of all new cars sold in China.

China is also positioning itself as a leader in the field of humanoid robotics, a market forecast to reach one million units by the 2030s. A state backed venture capital fund of USD 138 billion is targeting strategic technologies such as robotics and quantum computing. Although the Chinese model favours large-scale state support over capital efficiency, it has proven highly effective in driving high-end manufacturing.

In AI, China has shown it can compete globally. DeepSeek, launched in January, performs on par with Western models but at a fraction of the cost.

For investors looking to gain exposure to tomorrow’s tech leaders, exposure to China is becoming increasingly essential.

More generally, today’s emerging markets differ significantly from those of a decade ago. In India, we’re investing in wealth managers targeting the growing middle class, in China it is future technology leaders, and in Taiwan it is the world’s top chipmaker. In all cases, the common thread is long-term growth at reasonable valuations.

Conclusion

We believe that the investment case for investing in emerging markets is becoming increasingly difficult to ignore. Fifteen years of underperformance compared to developed markets, policy uncertainty in the US and a strong macro backdrop with weakening US dollar are creating a more favourable environment. We have seen this play out so far this year, with emerging markets outperforming the S&P 500 by 10% so far.

Meanwhile, structural shifts such as the underappreciated innovation boom in China and India’s demographic advantages clearly demonstrate the region’s long-term potential. With inflation largely under control and central banks beginning to ease policy rates, monetary conditions are also becoming more supportive.

For investors seeking growth at reasonable valuations, diversifying beyond developed markets appears to be a sensible approach. Emerging markets today are more resilient, more innovative, and more investable than ever before.