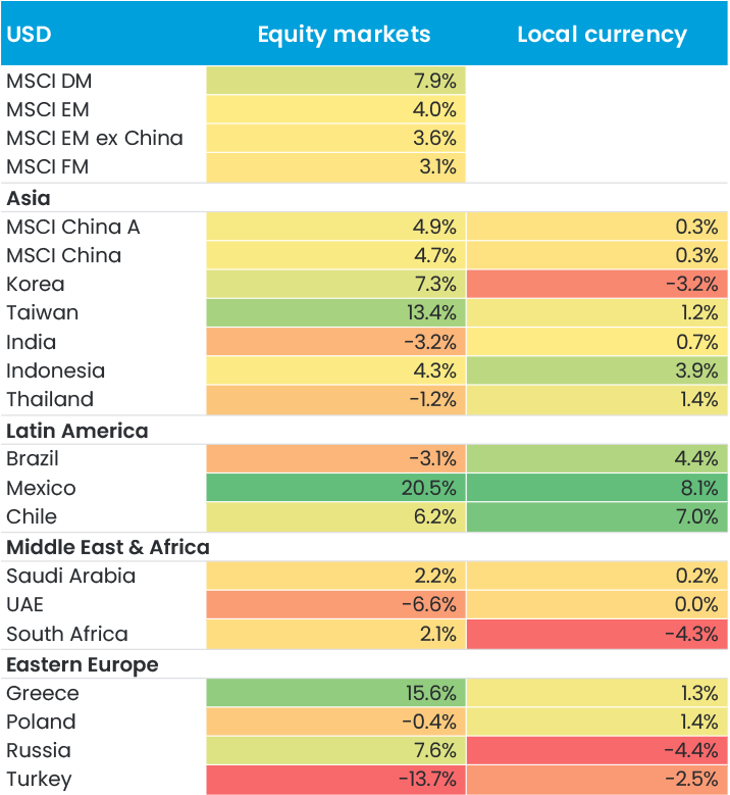

In our 2023 outlook, we suggested that 2022 had marked the end of an equity supercycle powered by cheap and abundant liquidity and that we were moving into a ‘fat and flat’ period, characterised by higher volatility and lower absolute returns. So far in 2023, this outlook seems to be playing out, although all major indices ended the quarter with solid positive returns, as shown in Figure 1.

Figure 1. Returns in USD for equity markets and local currencies in Q1 2023

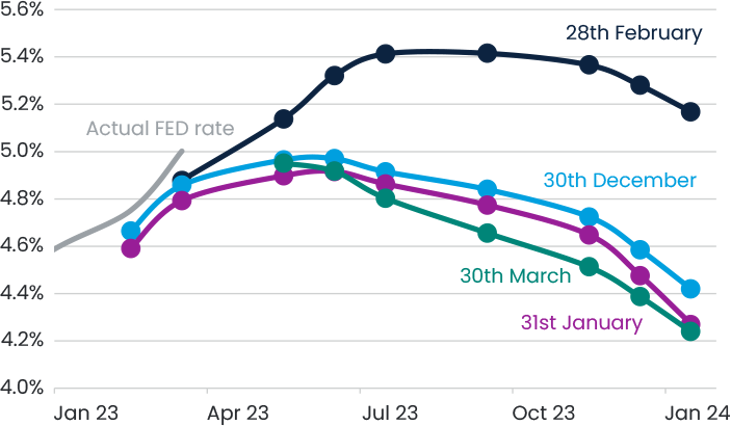

For emerging and frontier markets, as is so often the case, the three major drivers of returns were (i) global rates/financial conditions; (ii) China; and (iii) country-specific news. We will leave detailed commentary on the global backdrop to others, but cannot resist including the market-implied Fed futures curve as of the end of each month of the quarter (see Figure 2). This is probably the best illustration of just how volatile rate expectations in the period were. Such moves naturally have huge impacts on markets, most obviously for banks like Silicon Valley. However, as rate expectations plummeted in March, we saw a nice relief rally driven by the mega-cap tech names in the US. This was partly due to the Fed expanding its balance sheet by some USD 360bn, largely via its emergency Discount Window borrowing programme. This reversed over half of the USD 626bn of liquidity the Fed had removed since it started running off its balance sheet in mid-2022.

Figure 2. Market-implied Fed rates at various points in the quarter

In emerging markets, all eyes were on China’s reopening, which continued apace throughout the quarter. While all restrictions have now been essentially lifted, our on-the-ground take is that the reopening is a little different compared to the West, given the lack of cash handouts during the pandemic and a sense of shell shock among citizens who have faced restrictions for so long. We, and the many companies we have spoken with, do not see consumer spending drastically increasing, but rather ticking up moderately. Nevertheless, the opening has provided a welcome refocussing on growth from the Chinese government, and we see the recently announced GDP target for 2023 of “around 5%” as achievable and likely beatable, given the strong industrial activity data we have seen in Q1.

From a market perspective, the other positive tailwind for China has been increasing confidence that the regulatory crackdown, that started with the cancellation of the Ant IPO in November 2020, is coming to an end. This was most clearly indicated by the recent announcement of the Alibaba restructuring plan, which will unlock value in the company’s overlooked segments through separate governance structures and, potentially, IPOs. This sent the stock up 14% in a few days, adding some USD 45bn to the company’s market cap. We believe that, as the market gains more confidence in the improving regulatory backdrop, Alibaba (and the general Chinese market) can go higher, given the company is still trading on a forward EV/EBITDA ratio of 7x, which is close to record lows since the IPO in 2014.

Of course, it’s never completely smooth sailing in emerging markets, and in Q1 the level of geopolitical noise ramped up noticeably. Although China achieved a big (and surprising) win by brokering a deal that saw Saudi and Iran restoring relations, its implicit support of Russia and a high stakes battle for supremacy in chips/greentech with the US has rattled investor confidence. We do not think this noise will go away, although we hope it will calm down slightly and investors will focus on the strong growth and appealing valuations on offer in China. We like to invest into sectors that have the strong support of the government and structural growth, and there is no better example than the energy transition sector, where China invested USD 546bn in 2022, nearly four times the amount that we saw in the US. It is also worth mentioning that the Inflation Reduction Act in the US has also directly benefited some of our non-Chinese holdings, for example, the South Korean holdings that are building factories in the US.

Elsewhere in emerging markets, Korea and Taiwan (together 27% of the index) generally moved in line with the US market, although Taiwan was particularly strong on the back of improved hopes for the chip cycle due to growing demand driven by the global AI roll-out. India had a rare quarter of underperformance, due to a rotation into China and also a high-profile short-selling report attacking the Adani group of companies. For anyone who knows India, the report did not come as a surprise, as these companies were trading at extremely stretched valuations for no obvious reasons. The Adani companies have lost USD 126bn of value since the publication of the report (-53%), although the fall-out seems to have so far been fairly contained, particularly as the group has endeavoured to pay back debt, which reduces the systematic risk.

We travelled extensively in the period, with our team spending time on the ground meeting companies and other stakeholders in China (visiting both mainland and Hong Kong), India, Brazil, UAE, Poland, Vietnam and South Africa. While international travel is a sensitive topic, at a time when we are very consciously trying to reduce our carbon footprint, we really believe such trips are an invaluable way to understand what’s really happening in the local markets, what local investors are thinking and to meet a wide range of companies that we would have never met staying at home.>

On the sustainability side, news flow continued unabated. From our point of view, one of the most overlooked events was the publishing of the final draft of the Task Force on Nature-related Financial Disclosures framework, biodiversity’s answer to TCFD. The draft introduces three scopes for nature (as per climate) and some metrics they suggest using. Many of these metrics are ones we already look at, such as emissions, water usage and waste disposal, though it would be great to have all of them disclosed in a standardised and comparable way. The IPCC Synthesis Report on Climate Change was also published, which, as expected, made pretty depressing reading. However, we were encouraged by the fact that global emissions could be reduced by at least 50% by 2030 compared with 2019 levels, based solely on existing mitigation options that cost less than USD 100/t. CO2e. Given the carbon price in EU is already over this USD 100/t. threshold, we do think this should offer hope, but we would need a much broader roll-out of carbon prices in emerging markets, something we haven’t seen so far.

Probably the most material event was the European Commission’s proposals for a Net-Zero Industry Act and a Critical Raw Materials Act. The main goal of these acts appears to be about cutting red tape, which often hinders developments in Europe and, reducing reliance on China, which absolutely dominates the renewable energy supply chain globally. Our East Capital China-A and East Capital Global Emerging Markets strategies have had significant exposure to (and alpha generation from) these key sectors in China. We don’t think the acts will have much impact on our holdings in the short to medium term, because to build out an entire industry at scale takes a long time. As an example, Europe is excited about Enel's ‘gigafactory’ in Sicily, which currently has capacity of 200MW of solar panels that will rise to 3GW in 2024; one of our portfolio holdings will have a capacity of 90GW by the end of 2023.

Going forward, we expect that our ‘fat and flat’ scenario will continue to play out and volatility will remain high. In emerging markets, in particular, we do believe there is value on offer, especially for investors willing to stick their necks out, do the on-the-ground research required and pick interesting off-benchmark companies that should be able to perform despite the cycle. For example, in both our flagship funds (Global Emerging Markets Sustainable and Global Frontier Markets), active share is over 80%, with a significant proportion of off-benchmark names. Just as we are seeing in developed markets, we do believe quality names with strong balance sheets will continue to outperform, especially those that are reasonably priced and offer some growth with high clarity on earnings outlook. Handily, these are exactly the kinds of names we build our portfolios around, so we are strapped in and looking forward to seeing what the rest of the year brings.