Q3 was a difficult quarter for markets, as inflation in the US continued to surprise on the upside, giving the Fed little choice but to adopt an increasingly hawkish stance. As a result, the market moved from pricing a Fed rate of 3.0% in December 2023, to 4.3%. This had a significant impact on all risk assets, particularly as markets fretted about how such rates would affect global economic growth. This was accompanied by a surging US dollar, as investors flocked to the higher yields and perceived safety of “King Dollar”. Interestingly, emerging markets FX overall did not fare worse than developed markets, with key currencies like the renminbi, rupee, and Taiwanese dollar outperforming the euro (Figure 1). This is supported by the macroeconomic backdrop, as these countries are generally posting current account surpluses, enjoy manageable budgets, and are suffering less from the high inflation that is crippling much of the West.

Figure 1. Local currency return in quarter vs USD

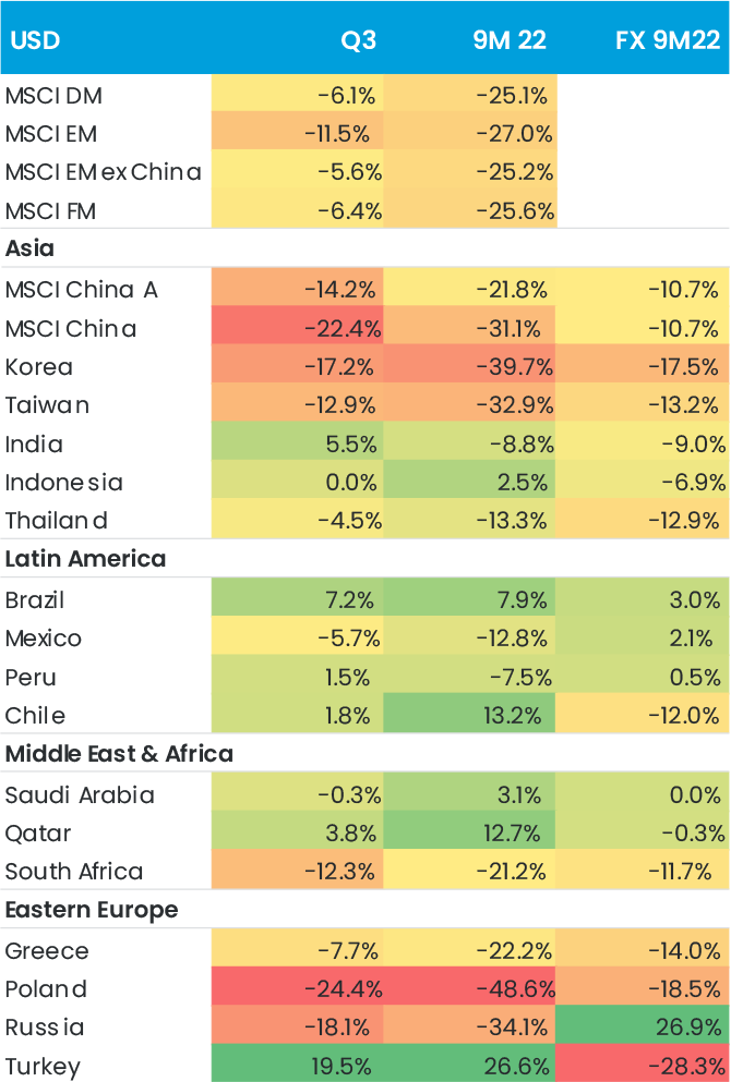

Figure 2. Market returns in USD

On top of this, the war in Ukraine raged on, with Russia ramping up the economic warfare by reducing EU pipeline gas exports by 49% QoQ and 80% YoY. This meant that European gas prices were up 22% in the quarter and 131% in 9M 2022, at USD 1,912/mcm. Europe has managed to fill up inventories thanks to increasing LNG supplies from the US and falling industrial demand – overall gas demand in Europe was 23% lower in August 2022 vs the 2019-2021 average. However, it remains to be seen what will happen in 2023, when the EU attempts to refill gas inventories without Russian gas. Clearly these prices have had a significant impact on Europe (see here an article we wrote on the topic), and led to a raft of windfall taxes on many companies benefitting from the prices. Elsewhere in the world, the pressure has not been quite so extreme, and indeed, Brent crude falling by 23% in the quarter to USD 88/bbl provided some welcome relief.

Emerging and frontier markets not immune to global sell-off, although some bright spots on the horizon

Emerging markets were of course not immune to these global pressures, with cyclical markets such as Korea and Taiwan proving the most vulnerable. China also sold off steeply after a strong Q2 as it became clear that growth would slow as well, with GDP expectations now at around 3-3.5% for this year, as opposed to the previous government target of 5%. On the positive side, one of the main drags on this performance has been the ongoing Covid lockdowns; we expect that these restrictions will be lifted next year, albeit more gradually than the market would like. It is clearly positive that the government is allowing the Beijing Marathon to take place in November, and we are also closely following a new Covid vaccine that is due to be rolled out over the next few months.

On another positive note, India stood out, with the market returning 5.5% in the quarter, due largely to an influx of capital from domestic investors, who appear to remain considerably more bullish on the prospects of Indian companies than international investors. The Association of Mutual Funds in India reported net inflows of USD 2bn for September, a 17% MoM rise. Fundamentally, the country is benefitting from a relatively strong macro backdrop (the OECD expects 7% growth this year and 6% growth next year) and moderate and manageable inflation of around 7%.

Other bright spots included the Middle East, thanks to its obvious commodity exposure and also pegged currencies. As well as a raft of social and economic changes, there is also something of an IPO boom in the region, with 24 IPOs in Saudi Arabia alone this year, and another 4 on the way1. This is highly welcomed by investors such as us, looking for exposure to the strong macro without investing in the extractive sectors. One company we like is Solutions, the leading IT services provider in Saudi Arabia, which is benefitting from the rapid digitalisation of the economy, including vital areas like smart cities, healthcare, and education.

On the frontiers side, Vietnam continues to outshine amid global macro uncertainty, with Q3 GDP growing by 13.7% YoY, resulting in 9M 2022 GDP growth of 8.8%, while inflation remains below 4%. This was not reflected in market performance, although we do believe that current valuations offer an attractive entry point given the valuation levels of 8.5x PE for 2023, with 15%+ earnings growth. In this country, we like consumer names, such as jewellery producer Phu Nhuan Jewelry with earnings growth of 90% in 2022.

A global wake-up call in in the climate race

Looking back at the global picture, the Inflation Reduction Act was passed in the US, which has been described as a “global wake-up call in the climate race”. This is expected to unlock more than USD 1 trillion in climate-related investments, which will be positive not just for the planet, but also many of our holdings. For example, half of our portfolio holdings in China in our Global Emerging Markets Sustainable (GEMS) fund are exposed to the global energy transition value chain, especially the solar value chain, where China’s share in all stages exceeds 80%.

As we’ve been out and about on the road meeting clients and portfolio companies, one overriding impression is that investors appear to be considerably more pessimistic than most businesses. This is especially the case for companies exposed to stronger economies – for example, we have been adding Aster DM Healthcare, a healthcare provider that earns 70% of revenues in USD from the UAE, a country expected to grow 6% this year and 5% in 2023. This is also true for companies in sectors with strong structural growth, like the largest pure-play residential energy storage company globally, which has returned us 127% since we added it in Q2. The selection of these sorts of companies is driving our strong relative performance, with our GEMS fund delivering 1.5% of positive gross alpha in the period, bringing us into the top one percentile performance since our inception in January 2019.

When opportunity knocks...

Looking forward, we have never seen high-quality companies trading at such low multiples. For example, our GEMS fund is trading at around 7x PE for next year, with around 17% EPS growth. Hence, for long-term investors there is clearly value on offer, assuming a willingness to ride out some volatility in the short term. This is especially true for emerging markets, given that many countries are at a very different point in the cycle to developed markets. However, we do accept that for things to stabilise and investors to start focusing on these strong underlying fundamentals, we will need more clarity on the Fed rate hike cycle and the impact it will have on global economic growth. The recent IMF forecasts were fairly gloomy, even without taking into account their downside scenarios, and so it’s clearly not going to be a smooth ride. However, we do believe that our investment philosophy of focusing on reasonably-valued companies that can perform and grow throughout the cycle will serve us well and continue to deliver value for our clients.

1 https://www.saudiexchange.sa/wps/portal/tadawul/markets/listings?locale=en

This information should not be considered an offer, solicitation, or recommendation for investment. This publication is not directed at you if we are prohibited by any law in any jurisdiction from making this information available to you and is not intended for any use that would be contrary to local laws or regulations. Access to our funds may be limited in some countries. Efforts have been made to ensure the accuracy of the information in this document, but it cannot be ruled out that it is based on unaudited or unverified figures and sources. Full information such as the prospectus, key investor information documents, articles of incorporation, and annual reports can be obtained on each fund page at www.eastcapital.com. Past performance is no guarantee for future performance. Fund units may go up or down in value up and may be affected by changes in exchange rates. Investors may not get back the amount invested.