Q4 was a solid quarter for global markets after a difficult year. Emerging markets returned almost 10% on unexpectedly positive news regarding China’s opening and a broad weakening of the USD against most major currencies, amid hopes of a Fed pivot.

Looking at the full year, emerging markets proved surprisingly resilient, given the large sell-off in developed markets. Total return was -20%, compared to -18% for developed markets. Typically, emerging markets are higher beta and underperform significantly when developed markets sell off –in the last 20 years for example, when developed markets have fallen, emerging markets have underperformed by over 10%.

Indeed, outside of the Asian giants of China, Taiwan, and Korea (together 58% of the benchmark), market performance was generally strong, with India down 5%, Brazil up 10% and South Africa down 2%. The unexpected winner was Turkey, which returned 117% as local investors flocked to the stock market to get some protection from the hyperinflation the country is experiencing, which peaked at 85% in October. Frontier markets did not enjoy quite such strong performance, dragged down by the largest country, Vietnam, which experienced idiosyncratic problems related to anti-corruption arrests and banking stress, which led to margin calls and a large sell-off.

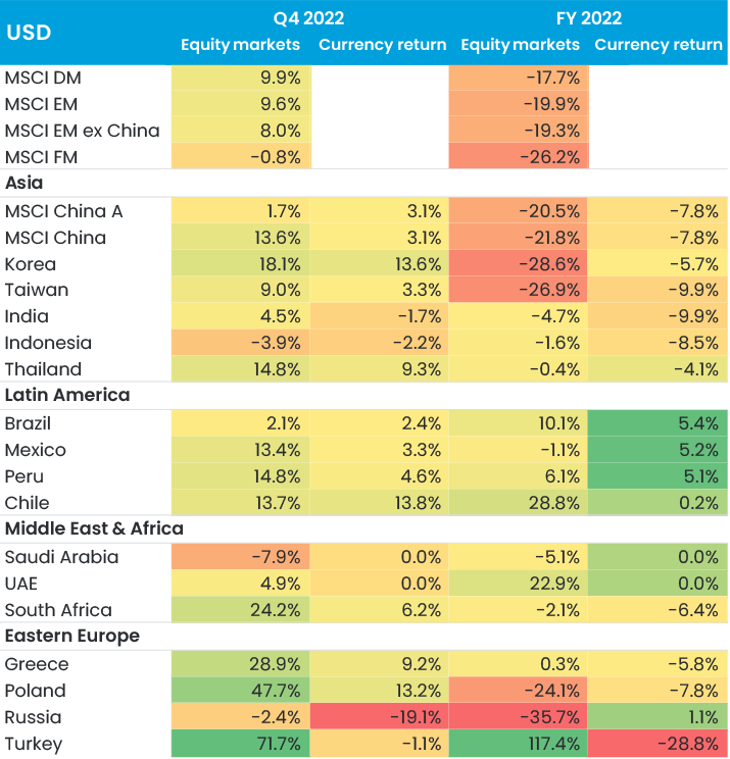

Quarterly and annual performance of markets and currencies, in USD

China reopening will power emerging market economic growth for 2023

All eyes were on China in the quarter. Initially, the news of the new Central Committee was taken negatively, as it concentrated power around President Xi Jinping. However, soon after it was announced that China was addressing its main issues – the Covid lockdowns that were crippling the economy and the struggling real estate sector. The speed of the opening shocked everyone, and the accompanying explosion in Covid cases (which are no longer reported) has got to the point where epidemiologists are talking about a peak already in Q1. This will have major implications, initially for any companies with significant parts of their supply chain in China, but also because it implies a fully open China with close to full immunity in Q2 2023. This was inconceivable a few months ago.

Goldman Sachs estimated a few months ago that the Covid restrictions were suppressing Chinese growth by 4-5% of GDP, and that much of it would be recovered on a full reopening. More importantly, excess savings in the country have reached some USD 290bn, or 2% of GDP. While this is well below the peak level in the US, where excess savings were above 10% of GDP due to the various government handouts, this will have significant impact on consumption in 2023. The comprehensive package of support for the real estate sector is less headline-grabbing, but also highly important, given that the sector is responsible for some 30% of Chinese GDP.

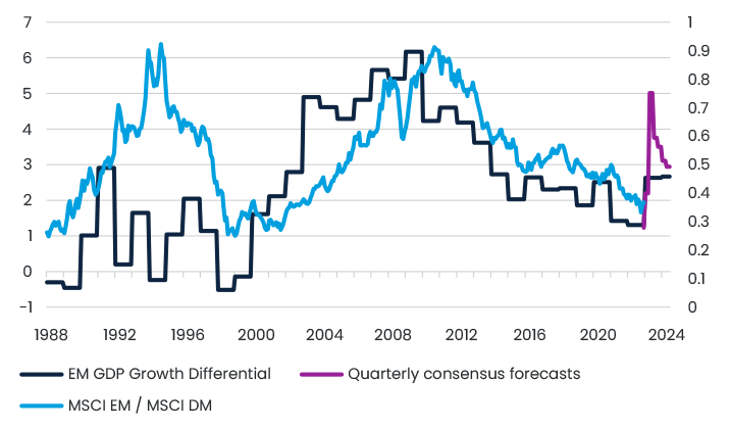

As a result, Chinese growth should come in at 5% in 2023 compared to 3% in 2022 - the only major country to experience an acceleration. This could have profound impacts on global commodity prices, something we do not believe is fully appreciated by markets. This also means that the emerging markets growth differential to developed markets will be higher than it has been for almost 10 years, something that is typically associated with emerging markets outperformance. It is important to stress here that it is not just China driving this differential, as many of the countries in emerging markets are not facing the same economic headwinds as Western countries. For example, Indian growth will likely remain at 6%, which is important, as the country weighting in the emerging markets index has increased from 9.2% at the end of 2020 to 14.4% at the end of 2022 – making it now the second-largest country.

Emerging markets growth differential accelerating to highest point in almost a decade

A “paris moment” for biodiversity?

The quarter was also notable for the COP27 on climate and the COP15 on biodiversity. While the former conference was fairly underwhelming in terms of concrete results, the latter did produce some interesting developments, with some commentators referring to a “Paris moment” regarding the Kunming-Montreal global biodiversity framework. The headline commitments do sound significant: to protect 30% of land and 30% of marine areas considered important for biodiversity by 2030, a new biodiversity fund supporting poorer nations, to which rich nations committed to pay an estimated USD 30bn a year by 2030, and a reduction in incentives/subsidies that are harmful to nature of USD 500bn by 2030. Currently, only 17% of terrestrial and 10% of marine areas are protected, so this is a significant step forward, although there is limited information on how these goals will be achieved.

While we are aware of how closely linked climate change and nature are, and how important nature is in general, it remains difficult for investors to systematically assess biodiversity impacts in their portfolios. For example, we have discussed deforestation extensively with a number of Brazilian banks. While they have sophisticated tools to ensure that none of their corporate clients are directly involved with deforestation, when it comes to their SME lending book and the supply chains of their corporate clients, there is simply no good way to assess this. This is similar to one of the main issues with climate – while we now have reliable and actionable data for companies’ Scope 1 and 2 emissions, Scope 3 remains something of a black box, especially for large companies with complicated and diverse supply chains.

Another event worth highlighting during the quarter was the UN PRI in Person, which we joined and where we spoke at a panel discussion on emerging markets. Our team on the ground wrote a short report providing the key take-aways.

What to expect for 2023?

In our 2023 Outlook, which we published a few weeks ago, we explain why we believe that we have now entered a period of “fat and flat” returns, with higher volatility and lower real returns. We remain of this view; 2023 will definitely not be smooth sailing. At the same time, if the US does manage to achieve a soft landing and inflation continues to fall, it will not necessarily be a terrible year for equities, as a lot of the bad news is priced in.

We do believe that emerging and frontier markets are well positioned, given the strong macro fundamentals, cheaper valuations versus historical levels, and the fact that we believe that we have passed the peak in USD strength. We have already started to witness this, with emerging markets returning 20% since 1 November, outperforming developed markets by 15%.

Across our portfolios, we have taken advantage of the significant sell-off to rotate into higher quality companies that we believe will be able to generate growth, defend margins and meet/exceed consensus expectations regardless of the macro backdrop. These companies are trading at appealing valuations well below their historical averages.

However, we remain humble and keenly aware of the top-down factors that drive stock prices as much as fundamentals; it is this combination of bottom-up and top-down analysis that has meant that our flagship funds have generated positive alpha throughout the cycle, with our Global Frontier Market fund and Global Emerging Markets Sustainable fund both (coincidentally) generating 12% of net alpha in the last 3 years.

This information should not be considered an offer, solicitation, or recommendation for investment. This publication is not directed at you if we are prohibited by any law in any jurisdiction from making this information available to you and is not intended for any use that would be contrary to local laws or regulations. Access to our funds may be limited in some countries. Efforts have been made to ensure the accuracy of the information in this document, but it cannot be ruled out that it is based on unaudited or unverified figures and sources. Full information such as the prospectus, key investor information documents, articles of incorporation, and annual reports can be obtained on each fund page at www.eastcapital.com. Past performance is no guarantee for future performance. Fund units may go up or down in value up and may be affected by changes in exchange rates. Investors may not get back the amount invested.