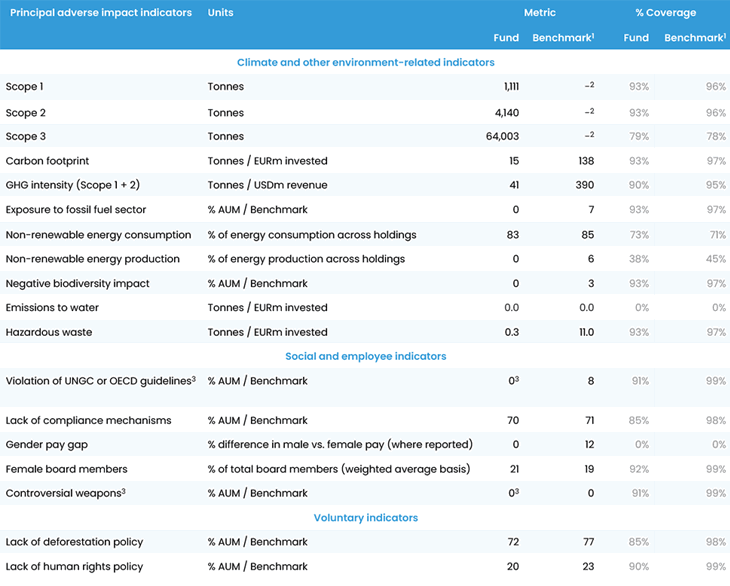

This report sets out the Principal Adverse Impact (“PAI”) indicators according to the EU’s Sustainable Finance Disclosure Regulation (“SFDR”). It then highlights the key metrics the portfolio management team uses to assess the impact of the fund’s investee companies on the surrounding world.

Principal adverse impact indicators

- Our fund’s GHG intensity is 77% below the benchmark. We do not invest in fossil fuel companies and would typically not invest in companies with a GHG intensity considerably higher than their peers.

- Our fund‘s exposure to negative biodiversity impact / hazardous waste is nil / very low, we would not invest in high risk companies as we avoid misalignment with SDG. We are TNFD early adopters and actively engage with portfolio holdings within Nature Action 100 initiative.

- Due to lack of data on gender pay gap (only 1% coverage) in our universe, we focus on board gender diversity. Our portfolio previously lagged the benchmark, but we are now above it as the proportion of female board members has increased materially to 23% from 14% in H1 2023. It remains a topic on which we often engage with our holdings. Read more here.

- As a Deforestation Investor Group member (aka DIG, previously called Financial Sector Deforestation Action), we map deforestation risks in our portfolio and engage with high-risk companies on deforestation issues.

Carbon intensity versus benchmark

- While the data in the table on the first page is largely sourced from an external provider, we also calculate fund carbon intensity ourselves based on reported Scope 1 and 2 emissions in our internal database (i.e. we include emissions of companies that may not be picked up by data providers).

- Data coverage has been increasing dramatically in the last few years to the point where there are just a handful of companies (<5%) that haven’t yet reported emissions, largely because they have recently listed and hence have not got their reporting systems in place. This is in part due to regulation (particularly in India), though also engagement efforts from investors like ourselves.

Case study Sustainability themes driving alpha

In H2 2025, we were one of only two foreign investors to participate in the IPO of Indian recycling company Jain Resources. The stock returned us 78%, generating 41bps of alpha in Q4 25. We also visited the company’s operating facilities in Chennai to assess the management of its operations, particularly given the limited ESG disclosure following its recent IPO.

Business model and sustainability impact

The company is a diversified recycling company, focusing on metals such as copper, lead and aluminium. Copper recycling is up to 85% less energy intensive compared to mining copper, while aluminium recycling is up to 95% less energy intensive than primary production.

Regulatory tailwinds and industry formalisation

Recycling can have a harmful impact on the environment and on workers, which is why the Indian government has moved to formalise the industry. This is a trend that Jain is benefiting from. For example, the Extended Producer Responsibility (EPR) Act requires battery OEMs to use an increasing proportion of certified recycled lead. Jain is one of the few companies able to provide this.

Site visit: E&S management

During our site visit we inspected the lead recycling units, which use automated battery breakers. These fully enclosed machines crush batteries and automatically separate lead, plastic and acid, thereby removing workers’ exposure to hazardous materials. The company also operates a zero-discharge policy, meaning that even the plastic is recycled rather than stored.

In addition, the use of scrubbers ensures that any air leaving the smelting unit passes through a series of treated filters that trap lead dust and neutralise acidic gases (SOx) before they reach the atmosphere. As such we left satisfied that the company was adequately managing its environmental and social (E&S) footprint.

SDG impact

We assess SDG impact using a proprietary tool, which is explained in detail in a PRI case study and featured as a best practice responsible investment example for China.

East Capital SDG VCA (value chain analysis) looks across the value chain of each company to identify the two most material SDGs for a company’s value chain. The tool gives a score of -100 to 100, based on current impact and a 3-5 year outlook. Impact is assessed based on materiality, intentionality, additionality and criticality.

We currently assess that 35% of the fund has a strong positive impact on one or more SDGs. Because we require a score of above 25 (“weak positive impact”) to be included in the portfolio, 100% of our companies have a positive impact on one SDG.

Case studies

SDG 1: No poverty

Gentera is the leading microfinance institution in Mexico and Peru, providing financial services to the underserved segment in the region. They have been the gateway to the financial system for more than 13 million people.

SDG 4: Quality education

Laureate Education is the largest provider of private universities in Mexico, with 47% of its 470,000 annual students being first generation. In 2024, the company provided USD 485 million in scholarships and discounts.

SDG 7: Affordable and clean energy

Cenergy is a Greek company which controls 60% of the inter-array market (cables that connect offshore wind projects), among a wide range of other cables. The company has SBTi targets for all its subsidiaries and strong ESG metrics.

SDG 11: Sustainable cities and communities

Aldar Properties is one of the UAE’s largest real estate developers, with SBTi‑approved near‑term emissions‑reduction targets covering Scope 1, 2 and 3. On a like‑for‑like basis, before the expansion of reporting boundaries in 2024, Aldar achieved a 7% reduction in Scope 3 emissions between 2021 and 2023. The company also continues to advance its energy transition, maintaining a renewable‑energy share of over 30% in its latest reporting cycle.

SDG 12: Responsible consumption and production

Converge, the largest broadband provider in the Philippines, reduced its network GHG intensity by 39% between 2022 and 2024 (from 2.3 to 1.4 tCO2e per petabyte), while sourcing 35% of its power from renewable energy in 2024. The company is targeting a 75% reduction in Scope 2 emissions by 2030.

Stewardship

- During 2025, we voted at 70 meetings (86%) of the 81 shareholder meetings where we were able to vote; in 11 meetings (21%), we voted against some items.

- We voted against items that are not aligned with our voting policy, part of our ESG policy, such as insufficient gender diversity at board level or overly long auditor tenure.

Voting is an important part of our active ownership efforts, and we typically follow up with management when we vote against items to ensure they understand the rationale for our actions.

Paris-Aligned Benchmark (PAB) exclusion criteria

Implementation: As of 2025, we have implemented the EU Paris-Aligned Benchmark (PAB) exclusion criteria for funds with sustainability-related terms in their names. This ensures that our strategies meet the highest regulatory standards for sustainable investing.

The criteria include the exclusions of companies involved in:

- Controversial weapons

- Tobacco cultivation and production

- UNGC/OECD guideline violators

Companies with

- ≥1% of revenues from coal & lignite

- ≥10% of revenues from oil fuels

- ≥50% of revenues from gaseous fuels

- ≥50% of revenues from power generation with a GHG intensity

of >100 g CO2e/kWh

Compliance: We confirm that the fund is fully compliant with the PAB exclusion criteria. This strengthens our sustainable investment approach and provides additional assurance to clients that our strategies align with Europe’s most ambitious standards.

PAB exclusion engagement update: Engagement with BYD

We started an engagement with BYD following news, at the end of 2024, that subcontractors for the construction of their new mega factory in Brazil were found to have forced labour conditions for their staff. We are maintaining an ongoing dialogue focused on understanding the measures BYD has implemented, or plans to implement, beyond the remedial actions taken in response to the allegations. We also continue to engage with BYD on several other topics, including corporate governance, responsible mineral sourcing, human capital management, and climate-

and biodiversity‑related risk management and reporting.

Sustainable Investment Definition

- ESG analysis at East Capital is done by the Portfolio Managers and Analysts who cover the companies using robust proprietary tools, such as East Capital ESG scorecard and East Capital SDG VCA, and reviewed by the ESG team.

- We classify “sustainable investment" using 3 binding elements that leverage the results of these proprietary tools. These elements are outlined below.

- As of 30 December 2025, we assess that 97.5% of the fund was classified as sustainable.

- We had two positions in “not sustainable” investments, which represented 1.5% of NAV in total. We also had 1% of cash, which we maintain for liquidity reasons.

-

Sector based and norms-based screening

I. Companies with >5% of their revenues from fossil fuels, weapons, tobacco, gambling, pornography and alcohol;

II. We also use a third-party provider to check for breaches of UN Global Compact. -

SDG VCA tool of at least 25

I. This ensures companies have a net positive impact on the SDGs -

Company is classified as sustainable as per our “three step test”

I. Contribution to E and/or S >60% score in E&S section of ESG scorecard. II. No significant harm to E or S No red flags related to E&S issues and compliance in screening. III. Good governance practices >60% in G section of ESG scorecard and no more than 2 red flags related to G.

1 MSCI Emerging Markets Index. No specific index has been designated as a reference benchmark for the purpose of attaining environmental or social objectives.

2 We do not report data for the benchmark because this is an absolute measure that is related to the size of the fund, i.e. owning 1% of a company with 100 tonnes of Scope 1 emissions would result in 1 tonne of Scope 1 emissions attributable to the fund.

3 While coverage by the data provider is below 100%, our investment and screening processes imply full portfolio coverage on this parameter.