Note to reader:

This commentary reflects market conditions and events per Q1 2025. Given the fast-moving nature of developments — particularly around global trade policy — some information may have changed materially by the time of reading. Investors should consider these comments in the context of ongoing market volatility and are encouraged to consult more recent sources for the latest developments.

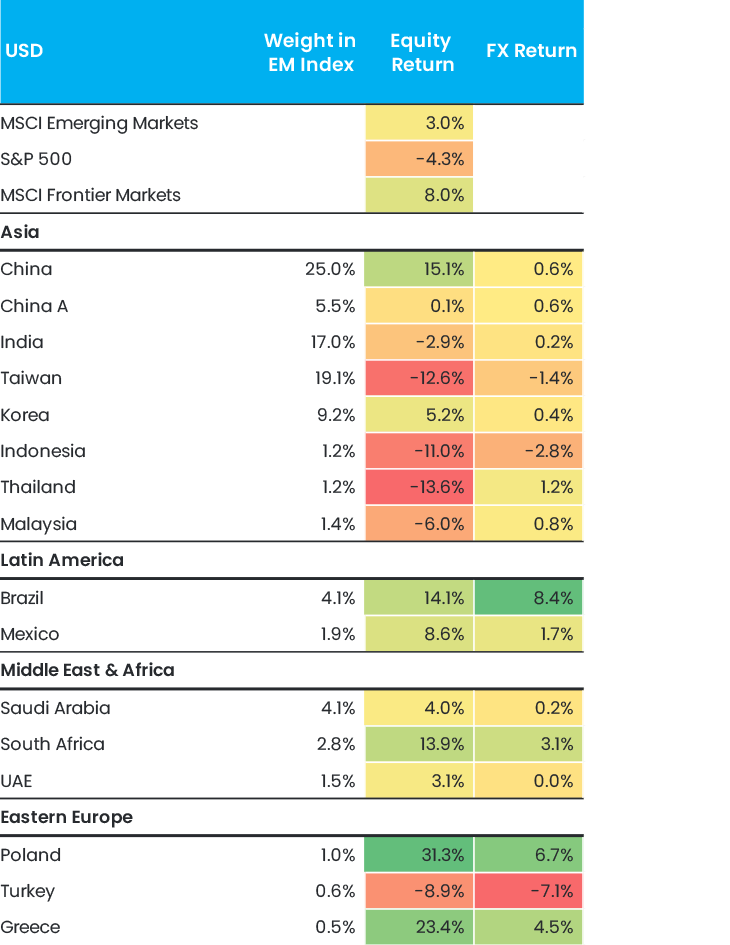

Q1 was a strong quarter for emerging and frontier markets, which returned 3% and 8%, respectively. Both markets significantly outperformed the S&P 500, which declined by 4%, marking the worst quarter for US markets relative to the rest of the world since 2002. However, all of this performance was lost after Trump’s “Liberation Day” tariff announcement, with the S&P 500 falling 11% in the two days that followed, and the Hong Kong’s Hang Seng index having its worst day since the 1997 Asian crisis on Monday 7 April, closing down 13.2%. Now, at the time of writing, the narrative has yet again changed.

Figure 1. Q1 2025 returns (USD)

China’s standout quarter

China was the standout performer in Q1, returning 15%. This was catalysed by the release of DeepSeek in January, followed by further AI models from listed Chinese companies such as Alibaba. The latest DeepSeek and Alibaba models are, respectively, ranked first and third globally among all well-known large language models (LLMs) in the Hugging Face LLM rankings, which assess LLM reasoning abilities using various benchmarks. Much attention has been given to the cost of these models; while actual costs may be slightly higher than reported, it is clear that they are significantly cheaper than the AI models developed in the US. As users of AI application programming interfaces (API) ourselves, we note that DeepSeek R1's API costs around USD 0.55 per million input tokens, compared with USD 15 for OpenAI’s GPT-4o.

Equally important is that DeepSeek is open source, and nearly all the Chinese companies we have spoken to are using the code in some capacity, with positive results. The Chinese government has also embraced the technology, with DeepSeek now acting as a third-party arbiter in hospitals in Hubei, resolving disputes between doctors over treatment decisions. We have written more about DeepSeek in this article.

Meanwhile, BYD launched its ‘God’s Eye’ self-driving technology, which is available on a range of vehicles, including the USD 10,000 Seagull model. These developments highlight just how wrong the prevailing market narrative is that China cannot compete in cutting-edge technology due to chip restrictions. In many areas, it is considerably ahead; Tesla charges USD 8,000 for its self-driving feature alone, and with significantly higher vehicle prices. Investors have taken notice of these developments, leading to strong but relatively narrow market performance year-to-date, concentrated in tech and robotics.

For China’s market rally to broaden, economic conditions remain crucial. After spending the past few weeks meeting companies in Hong Kong, we found a degree of cautious optimism, with signs of improvement in Q1 among certain companies. Key indicators, such as housing prices, appear to be stabilising and no longer declining month on month. We therefore still see significant value in China, provided the government continues its gradual stimulus measures, which we expect it will. We have been rotating out of tech names into high-quality non-tech companies that exhibit strong growth yet trade at attractive valuations.

A mixed picture elsewhere in emerging markets

Elsewhere in emerging markets, performance was more muted, with two other large markets, Taiwan and India, returning -13% and -3%, respectively. During the quarter, we visited Taiwan, including TSMC’s headquarters. Our view remains that the AI hype was largely priced in by late 2024 and recent negative sentiment from DeepSeek’s emergence and a broader Nasdaq sell-off has impacted Taiwan. That said, we see significant value beyond tech hardware (for example, car parts) and anticipate the next catalyst for tech stocks will be a revival in the consumer electronics cycle, potentially beginning in H2 2025 with the laptop replacement cycle and excitement around the new foldable iPhone.

India had a volatile quarter, with MSCI India down 11% at one point before recovering to -3%. The key driver for the sell-off was strong outflows from international investors rotating into China, compounded by concerns over a cyclical slowdown and weak earnings. We had previously reduced our mid- and small-cap exposure (by 7% of the Global Emerging Markets Sustainable fund) due to our own cautious outlook, but now see more reasonable valuations and are selectively adding high-quality names with strong earnings visibility at attractive prices.

Frontier markets and Eastern Europe power ahead

Frontier markets delivered another excellent quarter, returning 8%, driven by strong rebounds in Morocco (+27%) and Slovenia (+26%). These markets tend to have more idiosyncratic growth drivers and are therefore less exposed to global tariff wars than larger economies.

One of the most exciting regions in Q1 was Eastern Europe, with Poland gaining 31%. We have long argued that the region, and Poland in particular, was pricing in an excessively high equity risk premium due to the Ukraine war. Clearly, this premium is now starting to decrease amid signs that the conflict may be nearing resolution. While US tariffs will impact Eastern Europe, this will be at least partially offset by increased German spending, particularly in defence. We have significantly increased our Polish exposure within our regional funds to capitalise on this opportunity.

On-the-ground insights and sustainability

It has been a busy period for travel, with our team visiting Vietnam, the Philippines, Sri Lanka, Taiwan, India, China and Hong Kong. These trips provide not only opportunities to meet promising companies but also valuable insights from other market participants and stakeholders, helping us understand broader market drivers beyond company fundamentals.

On the sustainability front, we published our H2 Impact Report for our Global Emerging Markets Sustainable fund. A key highlight is that 85% of our portfolio companies now report Scope 1 and 2 emissions, a significant improvement from 35% in 2020. We think numbers like these go a long way to addressing the many questions we receive about the availability of sustainability data in emerging markets. This progress reflects both investor engagement from managers like us and regulatory changes, such as India’s mandate requiring all companies to disclose emissions.

Tariffs remain front and centre

Trump's "Liberation Day" announcement, which came after the quarter end, was in many ways the worst-case scenario. The US imposed a baseline tariff of 10% on all countries (excluding certain goods such as semiconductors) and much higher tariffs on certain key trading partners. The market has been in a bit of a freefall since then, especially after China announced its willingness to retaliate by increasing tariffs on US goods and opening up investigations into US companies operating in China.

The big question going forward is the extent to which Trump is willing to negotiate. As is often the case with his administration, the messaging has been mixed, and he has occasionally indicated that there would be room to reduce tariffs, for example with China if they would agree to the sale of a majority stake in US TikTok to a consortium of US investors.

We are keeping a level head, trimming certain positions where we feel the risk-reward no longer looks appealing, while of course being on the lookout for stocks that we believe have sold off excessively, regardless of the fundamentals.

As opposed to the US, investor positioning in emerging and frontier markets remains light, particularly among US investors, who control the majority of global AUM. Moreover, not all markets are hit evenly – for example Goldman Sachs estismated that India’s GDP would be reduced by just 30bps, but this would be offset by lower oil prices (10bps) and interest rates (10bps).

If the tariff situation takes a positive turn, it wouldn’t be unreasonable to expect that emerging and frontier markets could continue their outperformance. The tit-for-tat taking place between the US and China at the time we are writing this commentary is indeed worrying and we, along with the rest of the world, will be watching closely.

Performance in USD net of fees.

This is marketing communication. This publication is not directed at you if we are prohibited by any law in any jurisdiction from making this information available to you and is not intended for any use that would be contrary to local laws or regulations. Every effort has been made to ensure the accuracy of the information, but it may be based on unaudited or unverified figures or sources. The information in this document should not be considered investment advice and should not be used as the sole basis for an investment decision. Please read the Prospectus and the KID, which are available on the fund pages at www.eastcapital.com