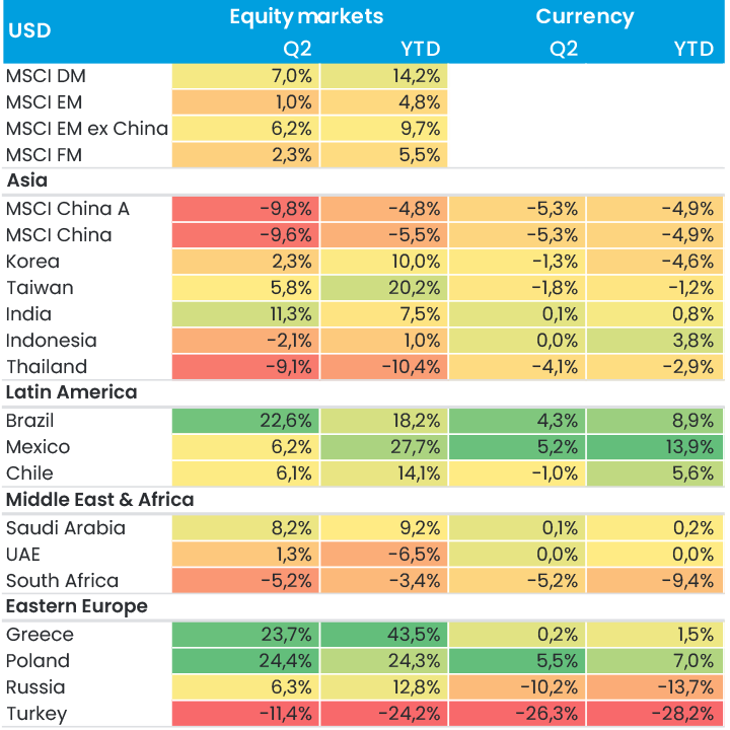

Q2 2023 was another interesting quarter for global markets, largely characterised by the steep rise in the ‘magnificent seven’ group of stocks in the US. In emerging markets, overall returns were dragged down by China, which fell 10% on a combination of deteriorating geopolitics and signs that post-Covid economic growth was slowing, rather than accelerating as many expected. Outside of China, returns were solid, with India posting an 11% return on strong economic data and Brazil rallying by 23% as the market started pricing in a first interest rate cut in August 2023.

Figure 1. Total return in USD

All eyes remained firmly on China in the period, which has the largest weight in the emerging markets benchmark, at around 30%. The quarter saw a deterioration in activity metrics across the board, with sequential falls in industrial profits, manufacturing PMIs below 50 and service PMIs slowing sharply. The most worrying signs for us are inflation, which slowed to 0.2% YoY as a result of low demand, and surging youth unemployment, which exceeded 20% recently and will grow further as 11.6 million new college graduates enter the workforce now in June. The silver lining, however, is that the Chinese government clearly has both the capacity and political need to provide some form of significant stimulus. We expect this will be a mix of targeted fiscal and monetary policy and note that July is something of a key policy window for announcing such a package, so we are watching carefully.

Geopolitics remains an even more complicated issue, as containment of China’s technological and military ambitions has become an important and prominent policy goal of most Western governments. In the quarter, we saw the US continuing its carrot-and-stick approach of trying to improve relations, with a visit by Secretary of State Blinken and a second visit by Treasury Secretary Yellen set for four days in early July. Further, there were supportive comments from Biden, including that he expected a thaw in relations very shortly, explaining that “everything changed in terms of talking to one another”. At the same time, the US announced a tightening of chip export controls, which will materially limit China’s ability to build and use sophisticated AI. China has responded by limiting exports of gallium and germanium, two key semiconductor manufacturing inputs for which China controls 98% and 68% of production, respectively. These are likely just the first moves in the ‘chip wars’, which will likely dominate headlines for months if not years.

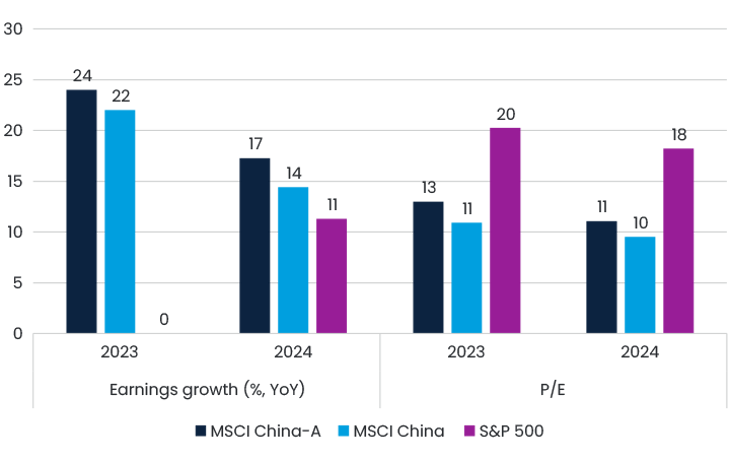

However, if there is one thing our 26 years of investment experience has taught us, it’s that predicting geopolitical developments is a difficult game, so we are not going to make any bold forecasts as to what happens next. Instead, we offer a simple observation; when speaking to various market participants, it’s clear that sentiment around China is extremely poor – by far the worst we have ever seen. This is evident in the valuations shown in Figure 2. Chinese firms are trading at 11–13x PE for 2023, compared with 20x for the S&P, despite the fact that earnings growth will be 22–24% for Chinese firms versus 0% for the S&P. We therefore believe that, barring any significantly negative developments, investors will start to look at China again as the AI hype fades and we see some form of stimulus from the Chinese government.

Figure 2. Growth and valuations in China and US

Outside of China (i.e. 70% of the emerging markets index), the picture is much clearer. Emerging and frontier markets are at very different points in the cycle from developed markets and are not suffering from the same recessionary risks as the West. Moreover, they offer superior earnings growth and are trading at considerably cheaper valuations (India excluded). We therefore believe this is an asset class worth considering, particularly as the Fed rate hike cycle peaks and investors focus more on underlying economic strength. In this situation, we would expect a slight weakening in the USD, which is a key driver of emerging markets’ outperformance.

One of the most insightful meetings we had in the period was with India’s Central Bank Governor Shaktikanta Das. The government and central bank have done a fantastic job managing Covid-related pressures, with May inflation falling to 4.3%, not that far off that of the US. Now all the focus is on economic growth, which should remain above 6% for the foreseeable future. One of the most interesting growth drivers is the digitalisation of the economy, which will bring hundreds of millions of Indians into the formal economy. This ‘mobilisation of money’ will have strong multiplier effects for growth and drive new spending patterns across the country. India is also benefiting from almost unconditional strong support from the West as a counterbalance to China’s dominance, with lots of large companies looking to move manufacturing to the country. As a result of the strong economic and stock market performance, India has increased from 8% of the benchmark in November 2020 to 14% now; we believe this weight will continue to increase going forward.

It was another busy period for us in terms of travel, visiting Delhi, Seoul, Athens, Warsaw, Istanbul, Dubai and Shanghai. In all of these locations, we came to the same conclusion; despite a somewhat excessive focus on top-down macro, interest rates and the US economy, time after time we met high-quality companies that were growing with stable or improving margins and trading at reasonable valuations, regardless of the broader cycle. It is these sorts of companies that we build our portfolios around, and the reason that our East Capital Global Emerging Markets Sustainable fund has been able to generate alpha every year since inception and 33% gross alpha overall since inception in January 2019. Similarly, our East Capital Global Frontier Markets fund has generated 42% gross alpha since inception in 2014.

We also attended the largest solar conference outside of China, in Munich (see here for the article we wrote on the topic). Global solar installation grew by 45% YoY in 2022 and is expected to grow by a further 43% in 2023, indicating that the exponential growth in supply that the world needs is taking place. The key driver for this is the rapidly falling costs, with solar now almost 50% cheaper than coal per MWh on a full-cycle basis. This renewables value chain (particularly in China) has been a key, profitable investment theme of ours for many years, and many investors are now questioning whether Chinese dominance could be a risk rather than an opportunity. While we believe the China+1 sourcing approach does make sense and will continue to gain traction, China’s dominance is such that there is simply no way to achieve a green transition without significant Chinese product for many years to come.

Outside of our global funds, it was pleasing to see Eastern Europe back on investors’ radars, with our East Capital New Europe and East Capital Balkans funds returning 19% and 20% YTD respectively, with the latter generating 26% of alpha and currently being one of the top ten funds on most Swedish platforms on a one-year rolling basis. This was driven by Greece, which is up 44% YTD as the incumbent prime minister’s New Democracy party won a commanding majority in the elections, giving him a strong mandate to accelerate his pro-business agenda. One of his main goals is to regain the country’s investment grade rating by the end of the year, and this is already starting to be reflected in the debt markets, with Greek 10-year bonds trading almost 50bps below Italian debt. In addition, our trip to Athens confirmed our belief that the country will continue to demonstrate the strongest economic performance in the Eurozone, with the IMF expecting 2.6% growth in 2023 compared with 0.8% for the Eurozone as a whole.

Finally, on the engagement side, we were pleased to see the formal launch of the Net Zero Engagement Initiative, which is engaging with companies one step down in the value chain from the larger Climate Action 100+ companies. The underlying philosophy here is to engage with the buyers of products produced by these large emitters to ensure clear and credible transition plans that are being executed on. We are lead investors on two companies and look forward to starting our engagement.

Going forward, we believe that H2 could look somewhat different to H1 as the market starts to look beyond the Fed rate hike cycle and AI hype towards the huge differentials in economic growth between developed and emerging/frontier markets, as well as the much more appealing valuations on offer there. Of course, noise levels will remain high, particularly regarding China, but we believe that a lot of the bad news is in the price.