This report sets out the Principal Adverse Impact (“PAI”) indicators according to the EU’s Sustainable Finance Disclosure Regulation (“SFDR”). It then highlights the key metrics the portfolio management team uses to assess the impact of the fund’s investee companies on the surrounding world.

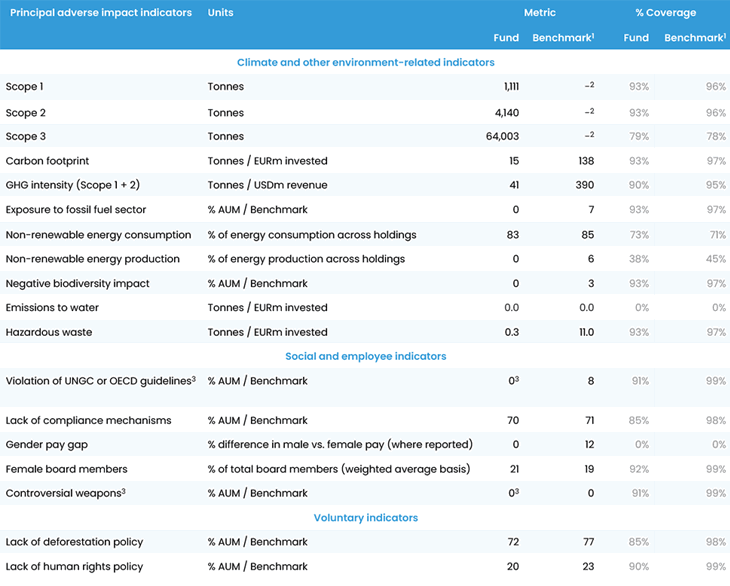

Principal adverse impact indicators

- Our fund’s GHG intensity is 82% below the benchmarks. We do not invest in fossil fuel companies and would typically not invest in companies with a GHG intensity considerably higher than their peers.

- Our fund‘s exposure to negative biodiversity impact / hazardous waste is nil / very low, we would not invest in high risk companies as we avoid misalignment with SDG. We are TNFD early adopters and actively participants with portfolio holdings within Nature Action 100 initiative.

- Due to lack of data on gender pay gap in emerging markets, we focus on board gender diversity. Our portfolio previously lagged the benchmark, but we are now above it as the proportion of female board members has increased materially to 21% from 14% in H1 2023. It remains a topic on which we often engage with our holdings. Read our article on Women in the boardroom.

- As a supporter to the Financial Sector Deforestation Action (FSDA) member, we map deforestation risks in our portfolio and engage with high risk companies on deforestation issues.

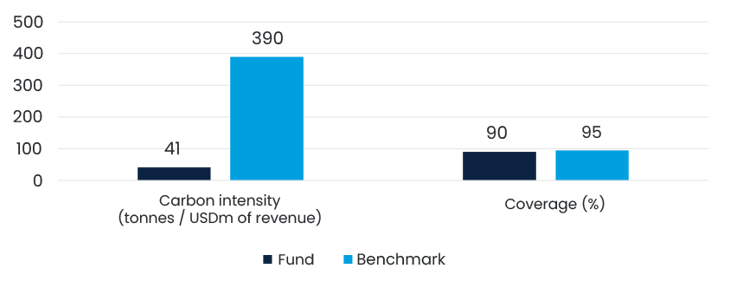

Carbon intensity versus benchmark

- While the data in the table above is largely sourced from an external provider, we also calculate fund carbon intensity based on reported emissions in our internal database (i.e. we include emissions of companies that may not be picked up by data providers).

- Data coverage has been increasing dramatically in the last few years, in part due to regulation (particularly in India), though also engagement efforts from investors like ourselves; for example, we actively participate in the CDP Non-Disclosure Campaign to improve climate-related data including climate data, targeting all our holdings in the fund which do not report to CDP. See the case study published by CDP.

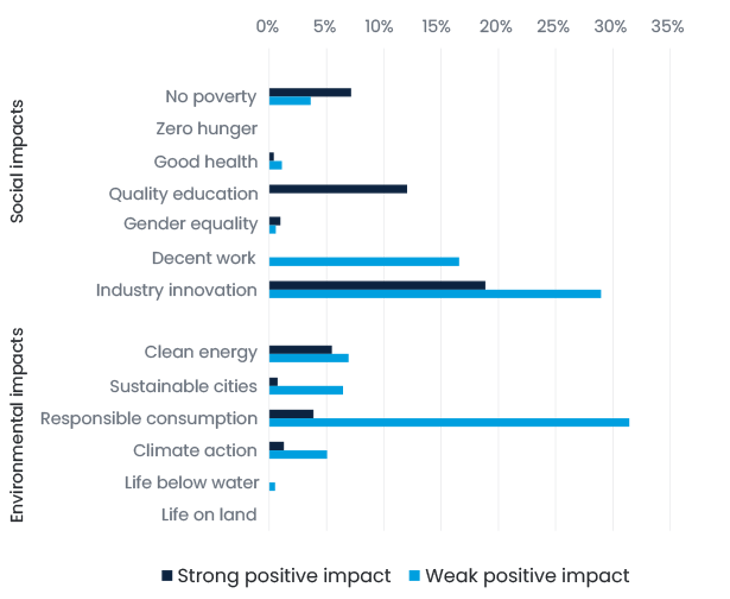

SDG Impact

- We assess SDG impact using a proprietary tool, which is explained in detail in a PRI case study and featured as a best practice responsible investment example for China.

- East Capital SDG VCA (value chain analysis) combines revenue exposure and SASB mapping to identify the two most material SDGs for a company’s value chain. The tool gives a score of -100 to 100, based on current impact and 3-5 year outlook. Impact is assessed based on materiality, intentionality, additionality and criticality.

- We currently assess that 48% of the fund has a strong positive impact on one or more SDGs. Because we require a score of above 25 (“weak positive impact”) to be included in the portfolio, 100% of our companies have a positive impact on one SDG.

Case studies

SDG 1: No poverty

Gentera is the leading microfinance institution in Mexico and Peru, providing financial services to the underserved segment in the region. They have been the gateway to the financial system for more than 13 million people.

SDG 4: Quality education

Laureate Education is the largest provider of private universities in Mexico, with 47% of its 470,000 annual students being first generation. In 2024, the company provided USD 485 million in scholarships and discounts.

SDG 7: Affordable and clean energy

Ceneregy is a Greek company which controls 60% of the inter-array market (cables that connect offshore wind projects), among a wide range of other cables. The company has SBTi targets for all its subsidiaries and strong ESG metrics.

SDG 11: Sustainable cities and communities

Aldar Properties is one of the UAE’s largest real estate companies, with SBTi approved targets (including for construction materials) and improving ESG metrics. For example, Scope 3 emissions fell by 7% between 2021 and 2023, and the proportion of renewable energy used increased by 30%.

SDG 12: Responsible consumption and production

Converge, the largest broadband provider in the Philippines, reduced its network GHG intensity by 39% between 2022 and 2024 (from 2.3 to 1.4 tCO2e per petabyte), while sourcing 35% of its power from renewable energy in 2024. The company is targeting a 75% reduction in Scope 2 emissions by 2030.

Stewardship

During H1 2025, we voted at 43 meetings (81%) of the 53 shareholder meetings where we were able to vote; in 11 meetings (21%) we voted against some items.

We voted against items that are not aligned with our voting policy, part of our ESG policy, such as insufficient gender diversity at board level or overly long auditor tenure.

Voting is an important part of our active ownership efforts, and we typically follow up with management when we vote against items to ensure they understand the rationale for our actions.

Engagement

Deepening our understanding of Taiwan's regulatory and business environment, with a focus on energy transition

During our four-day trip to Taipei and the Hsinchu Science Park in early April, we met with a broad range of stakeholders, including corporates (some of whom are in our portfolio), government officials, diplomats, think tanks, regulators, as well as asset owners and fellow asset managers. The main topics covered were climate goals, green finance, technological innovation, geopolitics and trade.

Highlights and key findings from the trip:

- Taiwan excels in AI, drones, and semiconductor foundry markets, with significant energy consumption concerns and efforts towards AI-empowered sustainability.

- Notably, we found that there is a clear carbon reduction plan and green growth funding, with the aim of reaching carbon neutrality by 2050 and creating 22,000 green jobs per month, with higher starting salaries.

- Banks are developing climate risk management pathways with varied targets and assessments, highlighting the need for clear, instructive goals.

- A particularly striking observation was that Taiwan faces challenges in power supply and market liberalisation, with carbon pricing mechanisms starting in 2025 and plans for cap-and-trade systems by 2027-2028.

- Resilience - in security, climate risks and business contexts, emphasises the need for diversified operations and cautious geopolitical navigation amid US-China tensions.

Case study

How we assess sustainability impact: UAE real estate developer Aldar

Our approach focuses on identifying companies that have a measurably positive impact on the material Sustainable Development Goals (SDGs) for the sector versus peers. In the UAE, Aldar Properties stands out among real estate developers.

Science-Based Targets

Aldar is the first real estate developer in the Middle East to have its near-term emissions reduction targets approved by the Science Based Targets initiative (SBTi), as illustrated in the table below. Scope 3 emissions include those generated from construction materials.

Clear improvement in metrics

In 2023, Aldar reduced its Scope 1 and 2 emissions by 10% year-on-year, increased the share of renewable energy in its portfolio to over 30%, and achieved green building certifications (LEED and Estidama) across more than 1.2 million square meters of its assets.

Pioneering embodied carbon management

Aldar has adopted a robust strategy for managing embodied carbon, requiring life cycle assessments for all new developments and targeting a 20% reduction in embodied carbon intensity (kg CO2e/m²) for new projects by 2030. Notably, flagship projects such as Saadiyat Grove achieved embodied carbon savings of over 15% in 2023 compared to conventional baselines, thanks to careful material selection and design optimisation.

|

Metric / Target |

2021 (Baseline) |

2022 |

2023 |

2030 Target |

|

Scope 1 & 2 Emissions (tCO2e) |

100% |

-5% |

-5% |

-42% (vs. 2021) |

|

Scope 3 Emissions (tCO2e) |

100% |

-3% |

-7% |

-25% (vs. 2021) |

|

Embodied Carbon Intensity (kg CO2e/m2) |

Baseline |

- |

-15% |

-20% (vs. baseline) |

|

Renewable Energy Share (%) |

10% |

20% |

30%+ |

>50% (indicative) |

|

Green Building Certifications (m2) |

0.8m |

1.0m |

1.2m+ |

Growing |

|

Potable Water Use Reduction (% per m2) |

0% |

-10% |

-15% |

-25% (vs. 2021) |

|

Construction Waste Diverted from Landfill (%) |

60% |

70% |

80%+ |

>90% (flagship) |

|

SBTi Target Status |

Not set |

Committed |

Approved |

- |

Paris-Aligned Benchmark (PAB) exclusion criteria

Implementation: As of 2025, we have implemented the EU Paris-Aligned Benchmark (PAB) exclusion criteria for funds with sustainability-related terms in their names. This ensures that our strategies meet the highest regulatory standards for sustainable investing

The criteria include the exclusions of companies:

• Controversial weapons

• Tobacco cultivation and production

• UNGC / OECD guideline violators

Companies with

• ≥1% of revenues from coal & lignite

• ≥10% of revenues from oil fuels

• ≥50% of revenues from gaseous fuels

• ≥50% of revenues from power generation with a GHG intensity of >100 g CO₂e/kWh

Compliance: We confirm that the fund is fully compliant with the PAB exclusion criteria. This strengthens our sustainable investment approach and provides additional assurance to clients that our strategies align with Europe’s most ambitious standards.

Example: Engagement with BYD

In mid-2024, we initiated a collaborative engagement with other shareholders and the Asia Corporate Governance Association (ACGA) regarding BYD's involvement in e-cigarettes, an issue identified under the new PAB exclusion criteria. The dialogue led to the company confirming that it had disinvested from this business. This successful engagement highlights our commitment to sustainable investing, demonstrates our ability to adapt to evolving standards, and shows how we can use our role as investors to drive positive change within companies.

In addition, we started an engagement with BYD following news, at the end of 2024, that subcontractors for the construction of their new mega factory in Brazil were found to have forced labour conditions for their staff. We are monitoring this issue closely, requesting more transparency and oversight, alongside other shareholders, in a dialogue which is still ongoing. Based on our materiality assessment, we do not consider this controversy to represent a risk that could jeopardise BYD’s license to operate. However, we continue to follow the situation to ensure the company remains compliant with point 3 of the PAB criteria (UNGC/OECD guidelines).

Sustainable Investment Definition

- ESG analysis at East Capital is done by the Portfolio Managers and Analysts who cover the companies using robust proprietary tools, such as East Capital ESG scorecard and East Capital SDG VCA, and reviewed by the ESG team.

- We classify “sustainable investment" using 3 binding elements that leverage the results of these proprietary tools. These elements are outlined below.

- As of 30 June 2025 we assess that 99% of the fund is classified as sustainable.

- The remainder of the “not sustainable” investments (1% of the NAV) was represented by cash, which the Investment Manager maintains for liquidity reasons.

-

Sector based and norms-based screening

I. Companies with >5% of their revenues from fossil fuels, weapons, tobacco, gambling, pornography and alcohol;

II. We also use a third-party provider to check for breaches of UN Global Compact. -

SDG VCA tool of at least 25

I. This ensures companies have a net positive impact on the SDGs. -

Company is classified as sustainable as per our “three step test”

I. Contribution to E and/or S >60% score in E&S section of ESG scorecard. II. No significant harm to E or S No red flags related to E&S issues and compliance in screening. III. Good governance practices >60% in G section of ESG scorecard and no more than 2 red flags related to G.

1 MSCI Emerging Markets Index. No specific index has been designated as a reference benchmark for the purpose of attaining environmental or social objectives.

2 We do not report data for the benchmark because this is an absolute measure that is related to the size of the fund, i.e. owning 1% of a company with 100 tonnes of Scope 1 emissions would result in 1 tonne of Scope 1 emissions attributable to the fund.

3 While coverage by the data provider is below 100%, our investment and screening processes imply full portfolio coverage on this parameter.