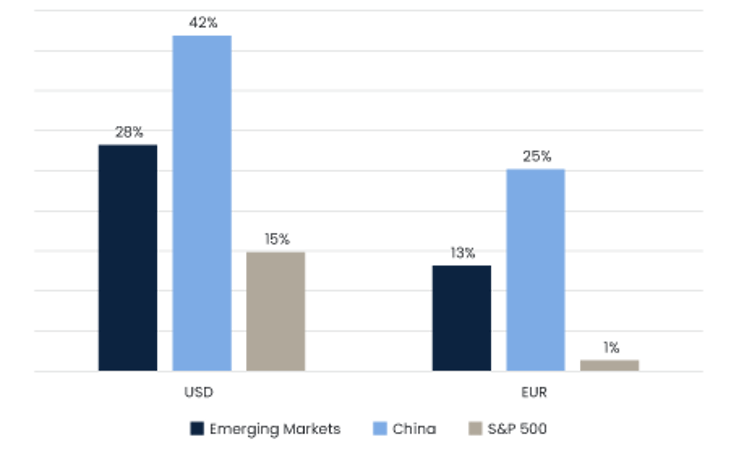

Q3 was another great quarter for emerging and frontier markets, with returns of 11% and 15% respectively in USD terms. Year-to-date, emerging markets are experiencing their strongest performance since 2017, with gains of 28%, driven in part by a resurgent MSCI China, which has risen by 42%. While we like to talk about performance in USD terms, the difference between USD and EUR returns (see Figure 1) is significant and highlights the extent to which currency movements have influenced overall performance. This underscores our view that the market’s rise resembles more of a “melt-up” rather than an unsustainable rally, reinforcing our positive outlook for the period ahead.

Figure 1. Total 9M25 return in USD and EUR

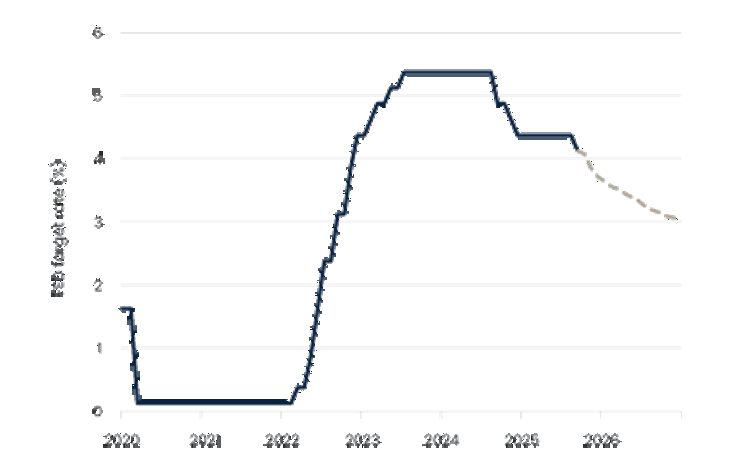

The main macroeconomic development during the period was, of course, the resumption of the Fed’s interest rate-cutting cycle (Figure 2), with markets now anticipating a further two cuts before year-end. This is a significant catalyst for emerging markets, which tend to perform well when rates are falling, provided that the US avoids a major recession. Lower Fed rates ease currency and, therefore, inflationary pressure, enabling central banks to reduce their own rates. This lowers borrowing costs, making it easier for companies to grow, and hence leading to economic and earnings growth. A good example of this can be seen in Brazil, where the current real rate (key rate minus the latest CPI figure) is just under 10%, suggesting that the cost of capital is just too high for many companies to consider meaningful growth investments. Consequently, the market is particularly rate sensitive, which is one reason why it has performed so well this year (+40%), as rate cut expectations have increased.

Figure 2. The Fed have resumed cutting rates

China’s equity market is starting to resemble that of the US in that it is driven mostly by the expectations and momentum of its tech stocks rather than by underlying economic activity. Indeed, Chinese equities surged 21%, not due to a stronger economy or improved consumer sentiment, but because of a liquidity-driven rally. Retail investors have shifted funds from low-yield deposit accounts into equities, particularly those of Hong Kong-listed banks and tech firms. As a result, names like Alibaba, one of our largest emerging market holdings, surged by 58% in Q3.

We have long believed that these Chinese tech leaders were undervalued, given their dominant position, and we see this rally as something of a catch-up. Yet, these companies remain somewhat misunderstood. Alibaba, for example, operates China’s largest e-commerce platform, with over 800 million active monthly users. It is also the country’s leading cloud provider, with a commanding 36% market share, greater than that of the next three competitors combined and it offers a large language model (LLM) that is on par with leading US models1. The cloud segment is growing particularly rapidly, with the Chinese cloud market expected to expand by 150% in 2025. Alibaba is well positioned to capture a significant share of this growth, as evidenced by the triple-digit growth in their AI cloud revenues during Q2. This leadership is set to continue, supported by a recently announced investment of USD 52 billion in cloud and AI over the next three years. Despite a +100% return this year, Alibaba still trades at just 12.8x EBITDA for the next fiscal year (ending March 2027), which we view as a reasonable valuation for such a dynamic company.

During the quarter, we also spent a lot of time digging into some of the lesser-known names in the Chinese tech space. We invested in the most exciting ones, such as Vnet, one of China’s largest independent data centre providers, which hosts for both Microsoft (exclusively) and Alibaba.

Outside of China, the Taiwanese and South Korean markets also delivered strong returns of 15% and 13%, respectively, driven by the continued momentum of the AI theme. This was reinforced by Q2 results, which showed that hyperscalers are now beginning to generate meaningful revenues from AI and are increasing their capital expenditure guidance. Microsoft, for example, increased its capital expenditure outlook from USD 85 billion to USD 100 billion this year, while Google raised its guidance from USD 75 billion to USD 85 billion. This cash is flowing into AI enablers in Taiwan and South Korea, such as TSMC, which manufactures all the leading-edge chips and has reportedly raised prices for its advanced chips by 5-15% in response to demand. Another example is Hynix, which produces 90% of the memory for Nvidia’s AI chips and is benefiting from a strong upcycle in memory prices, both the sophisticated, high-bandwidth memory used by Nvidia, and the more conventional DRAM. These two companies are also two of the largest holdings in our global emerging markets portfolio.

India has experienced another challenging period, largely due to international liquidity being drawn towards China, lower nominal growth as inflation falls and a deluge of negative headlines, particularly concerning geopolitical tensions and Trump’s escalating tariff wars. We anticipate that these headwinds will eventually ease, while the companies in our portfolio continue to grow, making current valuations increasingly attractive. However, we generally see 2025 as a year in which India is “taking a breather” after an incredibly strong 2024, with a resumed focus on the country likely to be seen in 2026.

Frontier markets maintained their strong momentum in the third quarter, with the benchmark index rising 15%, bringing the year-to-date gain to an impressive 38%. The rally was widespread but led by Vietnam, which benefited from rising turnover and renewed foreign interest amid growing anticipation around potential inclusion in the FTSE Emerging Markets Index. Beyond Vietnam, a softer USD helped to mitigate volatility across the universe, while ongoing economic growth and central bank rate cuts particularly supported the financial sectors. Despite the strong performance, frontier market valuations remain attractive, with a forward-looking P/E ratio of 6.5x representing near record-high discounts of 53% and 68% compared to emerging and developed markets, respectively. The macro backdrop continues to favour a selective exposure to countries with credible policy frameworks and improving growth dynamics.

Despite the holiday season, it was another active quarter for travel, with a particular focus on China and Korea, where we continue to see significant opportunities. We also had a productive trip to Dubai at the end of the quarter, uncovering several interesting opportunities that have experienced a sharp sell-off following the news that Saudi Arabia would be increasing its foreign ownership limits. This could potentially lead to larger benchmark weights and increased inflows. We registered a record number of client meetings and requests, which we see as a clear indication of rising interest and willingness to engage with emerging markets.

Looking ahead, a weaker dollar and falling global interest rates provide a supportive backdrop for emerging markets. This is particularly relevant as investors increasingly wake up to the fact that many AI enablers and other leading-edge technology leaders, such as CATL and key key electric vehicle (EV) / robot manufacturers, are based in emerging markets and trade at significantly more reasonable valuations than some of the US peers.

Performance in USD net of fees.

This is marketing communication. This publication is not directed at you if we are prohibited by any law in any jurisdiction from making this information available to you and is not intended for any use that would be contrary to local laws or regulations. Every effort has been made to ensure the accuracy of the information, but it may be based on unaudited or unverified figures or sources. The information in this document should not be considered investment advice and should not be used as the sole basis for an investment decision. Please read the Prospectus and the KID, which are available on the fund pages at www.eastcapital.com