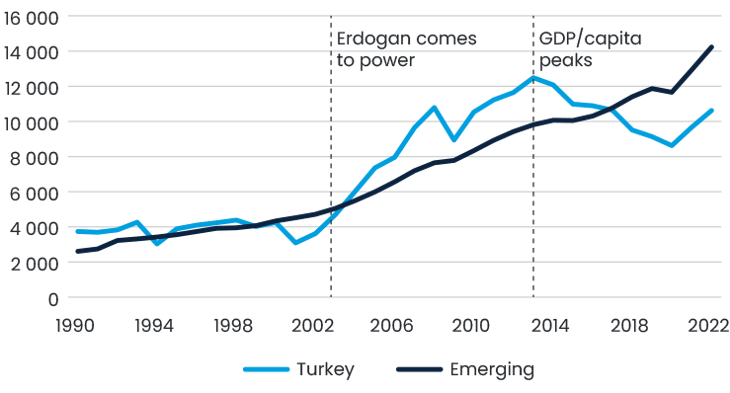

In 2017, Türkiye shifted to a strong presidential system and re-elected Recep Tayyip Erdogan as president in 2018 with increased powers, hoping to accelerate decision-making and stimulate the economy. Six years later, economic outcomes have been mostly negative, with a range of challenges causing investors to feel alienated. After having seen their per capita income climbing 3.5 times (2.1 times in emerging markets) during Erdogan’s earlier years to a peak at USD 12.489 in 2013, Turks lost 15% of their income between 2013 and 2022 compared to a 1.5 times increase overall for emerging markets (Chart 1).

Nevertheless, with the upcoming elections on May 14th, there is hope that the country may be able to turn things around.

Chart 1. Türkiye vs. Emerging and Developing Markets GDP per capita (in USD)

The frequently cited issue by investors and rating agencies regarding the root cause of Türkiye's economic troubles has been the deterioration in the quality of its institutions. The degree of the Central Bank’s (CBRT) independence is not even a major discussion point any longer. Erdogan’s push for his unorthodox belief that “high interest rates cause high inflation” is now embedded in the monetary policy of the CBRT. This has resulted in the CBRT cutting its key rate from 19% in 2021 to 8.50%, even as inflation skyrocketed from 19% up to 86%, before easing to 44% in April 2023. In the process, the Lira lost nearly 60% against the USD, and CBRT’s net international reserves (net of swaps) dipped into deep negative territory at USD -53bn. Once a preferred destination for international investors, the Turkish equity market saw endless outflows, with foreign ownership (as a percentage of the total market capitalization) declining from 24% in 2015 to a 17-year low at 9%. Investor-unfriendly regulations banning short-selling and stock lending even risked Türkiye being downgraded to frontier market status by MSCI back in 2020. As an outcome, equities have been relentlessly de-rated from a forward-looking price-to-earnings ratio of 11x to a mere 3.7x, one of the world’s lowest.

The election-driven policymaking has not been a remedy for Türkiye’s economic challenges with Erdogan coming to his senses, as some had hoped. However, a policy change, either as a result of a relieved Erdogan, if re-elected, or an actual change in government, may be the solution.

In the scenario where Erdogan wins the election, it is expected that the current policies and economic approach will continue. This could lead to further challenges in the economy and a continued alienation of investors. On the other hand, it is also possible that Erdogan might realize how difficult it is to keep the economy together given the complicated set of recently introduced rules and regulations, thus he may go back to orthodox policies. However, this would be met by international investors’ skepticism until there is a decisive and permanent positive shift in economic policies.

In the scenario where the opposition wins, the path will be more clear but likely bumpier. Leaders of the main opposition alliance have made their intentions clear about going back to orthodox economic policies which might bring about a major boost in sentiment. However, reversing or exiting some of the current unsustainable practices will require absolute precision in policymaking to avoid unintended consequences that could further harm the economy. For example, there is a growing consensus that the Lira might initially lose 15-20% after the election, partly due to declining CBRT foreign currency reserves amidst its fight against further depreciation. The unsustainable practices that need to be addressed include the foreign-currency protected deposit accounts (reaching TRY 2.1tn, or USD 109bn and ~12% of GDP), foreign central bank swaps and deposits (estimated to be nearly USD 30bn), and the unrealistically low policy rate at 8.50%. If this policymaking precision is achieved, improved economic conditions could lead to increased investments, a more stable currency and lower inflation, which in turn could lead to increased economic confidence and a positive feedback loop.

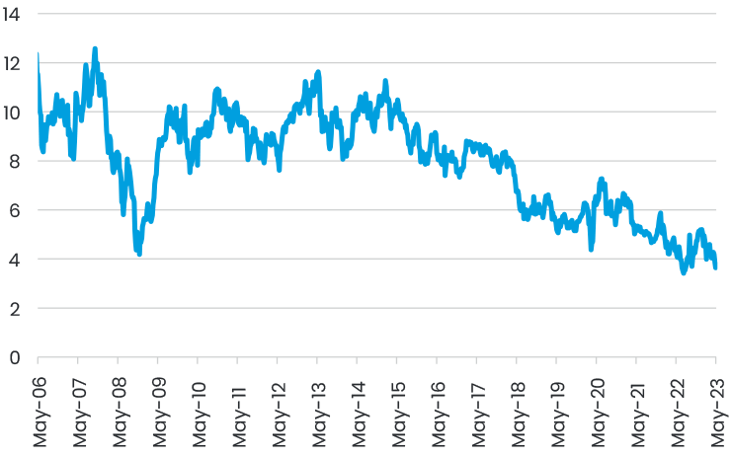

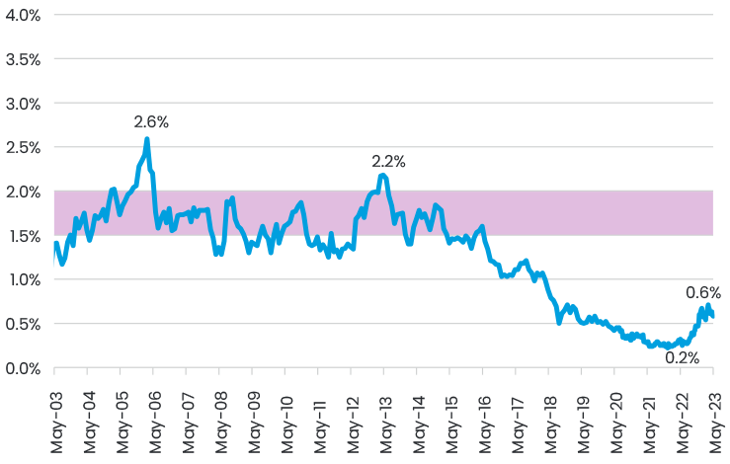

In such a scenario, we believe that Turkish equities may make a glamorous comeback on the global investors’ agenda due to growth prospects and attractive valuations both in absolute and relative terms. The still-high but declining inflation, increasing capital investments, and improving consumer sentiment could help Turkish companies grow their earnings by an average of 15-18% annually (in Lira) over the next three years. But more importantly, Turkish equities may see their P/E ratio re-rate from the current 3.7x towards 9x (a 34% annual re-rating in three years, excluding earnings growth), which was the average P/E ratio between 2006-16 when inflation was predominantly in single digits (Chart 2). From another perspective, Turkish equities’ P/E discount to emerging markets may gradually narrow from the current 65% to a 2006-16 average of 20%, suggesting a similar annual pace of re-rating at 37%. A combination of ~15% annual earnings growth and ~35% annual re-rating would result in a significant upside for equities, but the outcome may not be as straightforward especially given the likely Lira depreciation. However, even the prospects of such a development may help attract investors back to the country. Furthermore, the likely convergence of Türkiye’s country weight in the widely followed MSCI Emerging Markets Index, from the current small 0.6% to a likely range between 1.5-2% (2006-16 range), may act as another positive trigger for more investors to participate in the market (Chart 3).

Chart 2. Borsa Istanbul (Turkish equity market) forward-looking P/E Ratio

Chart 3. Türkiye’s weight in MSCI Emerging Markets Index

The argument that the election outcome, regardless of the winning side, can immediately contribute to resolving Türkiye’s economic challenges is difficult to make. However, the forthcoming election could prove to be a pivotal moment for the country's financial markets, perhaps the most crucial in over two decades. Despite the potential for best-case scenarios to not materialize in all areas, the risk-reward profile for long-term investors may quickly become favorable even if some of the low-hanging fruits are harvested.

Documents & links