From Frontier to Emerging: Romania's Journey Toward a Market Upgrade and the Implications for Investors

Romania is getting closer to an upgrade from frontier to emerging market status. What does it mean for investors?

One of the original Frontier Markets when MSCI launched the index in 2007, Romania has shown significant growth and potential in various aspects. Currently, the market size is USD 48 billion with 357 stocks listed and it trades with a median daily turnover of USD 6 million over one year. While it currently falls short of the liquidity criteria required for an upgrade to an emerging market by MSCI, the country is now getting closer to meeting the requirements for an upgrade given recent improvements and the landmark IPO of the nation’s largest electricity producer, Hidroelectrica.

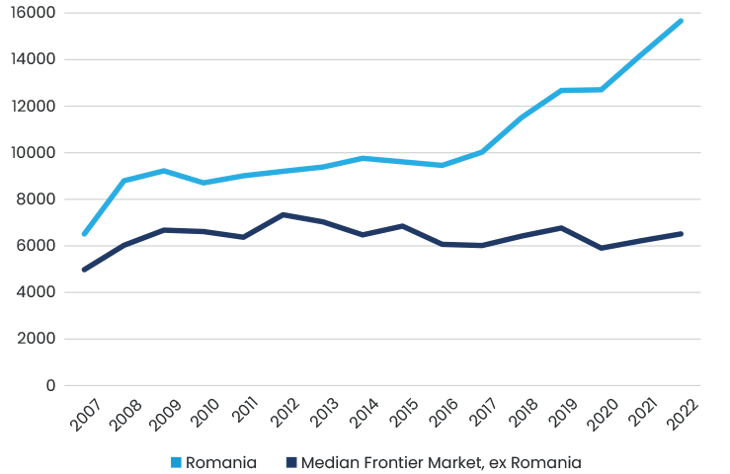

MSCI's market classification framework is based on three main criteria: economic development, size and liquidity of equity markets, and accessibility for foreign investors. Romania already meets the economic development and accessibility criteria for an emerging market. In fact, its gross national income (GNI) per capita places it among the upper half of emerging countries, and significantly above the median of frontier countries, with USD 15,660 GNI per capita, which is comparable to countries like Poland and Chile. Accessibility standards are also seen favorably by MSCI. However, the liquidity of Romania's listed equities are currently the only remaining hurdle.

Figure 1. GNI per capita, Atlas Method, current dollars

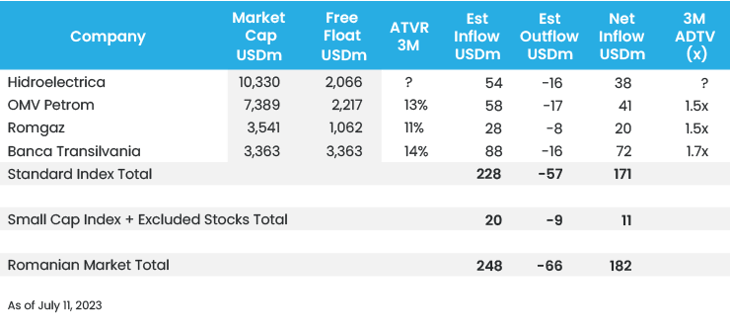

To be classified as an emerging market, MSCI requires a market to have at least three stocks with a market capitalization above USD 2 billion, a free float above USD 1 billion, and an Average Traded Volume Ratio (AVTR) above 15%. The market capitalization requirements are dynamic and entrance thresholds change to capture a target percentage of the market but at the time of writing, with Hidroelectrica’s IPO, which took place on July 12th, 2023, Romania will have four stocks that meet the market capitalization and free float criteria, although none currently meets the liquidity criteria.

Figure 2

Hidroelectrica's IPO brings forth a remarkable opportunity to amplify the Romanian market's exposure to a multitude of potential investors as the company is unique in the European utilities space. While there are many pure clean energy producers, none are as large as Hidroelectrica (USD 10.3 billion). Of the larger European utilities companies, none offer 100% clean energy making Hidroelectrica one-of-a-kind. The four times oversubscribed offering (USD 2.1 billion) garnered significant interest from local pension funds and foreign investors, particularly those seeking clean and green energy investments. Moreover, the anticipated positive spillover effects from Hidroelectrica's IPO are expected to contribute to an increase in liquidity for the rest of the market. Indeed, the large local institutional investors, dominating the Romanian market today, had been in the waiting mode ahead of the landmark IPO and are expected to increase their activity post Hidroelectrica IPO. This makes it plausible that the four companies will reach the required criteria that are only a small margin away from being fulfilled.

Attaining the status of an emerging market signifies confidence in Romania and its inclusion within a more popular and larger grouping of markets. Investors are willing to pay a premium for emerging markets compared to frontier markets due to their stronger fundamentals and market conditions. Currently, emerging markets trade at a forward P/E ratio of 12.0x, while frontier markets trade at 9.2x, indicating that on average, investors are prepared to pay a 30% premium for emerging markets. With Romania's potential upgrade, its fundamentals would remain unchanged, but the resolution of liquidity concerns that have deterred investors should be accompanied by a multiple expansion. We anticipate that Romania's forward P/E ratio could reach and surpass its historic valuation of 6.6x*, reflecting a 27% increase from the current record low levels of 4.8x.

In terms of investment flows, Romania's inclusion in the MSCI Emerging Markets Index would result in a transition from being a medium fish in a small pond to a small fish in a big pond. Assuming Hidroelectrica is included, Romania will move from having a sizable projected 12.2% weight in the MSCI Frontier Markets Index to a 0.10 – 0.15% estimated weight in the much larger MSCI Emerging Markets Index. Putting the picture together, the net passive inflows into Romania are projected to be USD 182 million. This flow of capital will provide a subdued increase in trading volumes, and companies in Romania’s index would benefit from 1.5 – 1.7 days of extra average trading volumes. When including additional flows from active investors, the net inflows could be increased by up to a factor of 2 or 3, adding significant support for the market activity and valuations. Nevertheless, further upside for inflows into Romanian equities can be limited by the very small weight in the overall MSCI Emerging Markets Index as most active investors with a focus on emerging markets might overlook Romania's potential.

At East Capital we invest in Romania since 2004 as part of our Emerging Europe and Global Frontier strategies as well as having a dedicated East Capital Balkan fund, where Romania has a significant weight of 18%. Being one of the first foreign investors in the market we have embarked on the journey of being a long-term investor in many of Romanian blue-chip stocks like Fondul Proprietatea, OMV Petrom and Banca Transilvania as well as supporting several successful IPOs such as Purcari Wineries or the recent Hidroelectica. During our recent travels to Romania in May this year, we were witnessing its rapid economic development bolstered by the inflows of EU funds and strong domestic demand. As a long-standing financial investor in the country, we are very happy to finally see a particularly important progress in the development of the Romanian capital market with the IPO of Hidroelectrica.

The potential upgrade to an emerging market status warrants this recognition, and the anticipated increase in liquidity is expected to attract more investors’ attention. We think this shift could lead to a positive transformation for Romania's market, offering new opportunities for both local and international investors.