The Korean market is typically perceived as relatively sleepy and unexciting by investors. However, on our recent trip, we sensed more excitement among both local and international investors, based on the much-discussed “corporate value-up program”. Japan’s experience does provide evidence that this works, with the main index TOPIX returning 22% in USD since January 2023 when their corporate governance reform program was announced.

Rise of the retail investor

One overlooked aspect that kept coming up in our discussions is that Korea has seen a surge in retail investors since COVID-19, to the extent that in 2023, retail investors comprised 64% of annual volume, compared to around 30% in the US and Japan. Indeed, the latest data suggests that there were around 14 million retail investors out of 40 million voters.

These retail investors have become increasingly active in demanding reforms from their investee companies, although they have also made improving equity returns a political imperative. The best evidence of this is the ban on naked short-selling announced in November, and it is likely to be the reason why these reforms were announced ahead of the mid-term elections in April 2024. However, the incumbent party will be under pressure to produce results ahead of the 2027 presidential election.

Cheap, complex and inefficient companies?

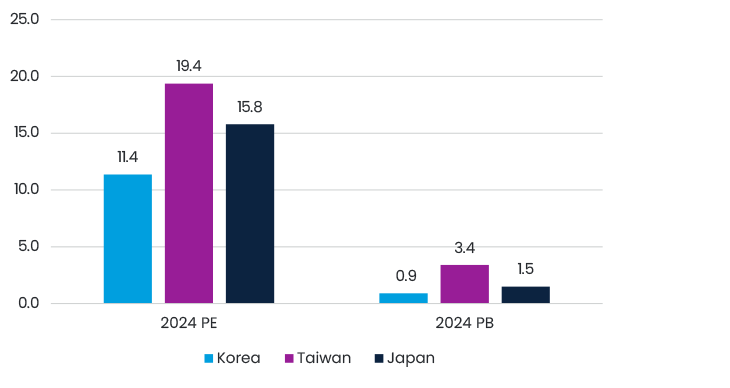

As shown in Figure 1, Korea’s stock index trades at valuation levels that are well below comparable countries such as Japan and Taiwan. On P/B for example, it trades below 1x, compared to 1.5x in Japan and 3.4x in Taiwan.

Figure 1. Valuations in comparable countries

Like Japan, this discount is driven by complicated corporate structures, low return on equity, and poor shareholder returns – in Korea, dividends are taxed at around 50% compared to zero capital gains tax, so there is no incentive for companies to pay dividends.

As such, the potential to improve governance, and hence shareholder returns, is very clear. This can work - if we look at Japan, the main equity index has outperformed the Korean index by 15% in USD since January 2023, following the announcement of their corporate governance reform program. Unfortunately, there are several key differences with this program compared to Japan – it is voluntary, with no “name and shame” approach, and there are no clear incentives for the hugely influential chaebols (big conglomerates) to take part.

In Korea, and also in discussions with the Korean regulator together with members of the Asian Corporate Governance Association, we have focused on possible policy measures such as tax benefits and improved corporate governance. On the tax side, measures include reducing tax liabilities by recognising the treasury share cancellation as an expense; corporate tax deductions on incremental higher dividends, and reduced dividend income tax for shareholders investing in high dividend stocks. To improve governance, the government plans to revise the commercial law to reinforce board responsibilities, enhance the efficacy of shareholder meetings, and broaden the appraisal rights of minority shareholders. Other incentives include offering a 1-3 year tax audit grace period, overseas IR opportunities and other financial incentives.

We spoke to Professor Mike Cho from Korea University Business School, who appears confident that this program will benefit investors. He thinks it will take time to implement the necessary steps to make changes, especially in the chaebols.

How do we play this?

In conclusion, we agree with Professor Cho that this program will benefit the equity markets, although likely at a more gradual and measured pace than many would like.

In our portfolio, we choose to play this theme through the Korean auto sector i.e., Kia, which traded at 0.8x P/B or 4.6x P/E 2024 in January. This was at a significant discount vs. Toyota (1.2x P/B, 9.0x P/E) even though Kia is shifting faster towards electrification and has a more attractive software implementation offering. Similarly, in the tech sector, we like Samsung Electronics at 1.2x P/B as compared to SK Hynix (2.1x P/B) or Micron (3.2x P/B). Samsung is trading at 14x 2024 P/E against 148% and 39% EPS growth in 2024-25. We believe the company is at the centre of the coming tech and AI upcycle thanks to its leading technology and market position in memory, foundry, smartphones and other businesses.

Documents & links