Cowritten by: Eglé Fredriksson, Dilara Saygi, Michał Czerwiński and David Nicholls, CFA

Eastern Europe has some of 2023’s best-performing equity markets globally, with large markets such as Poland rallying 52% and Greece gaining 48%1. This was driven by valuations 40-45% below historic averages, an improved economic and political outlook and easing inflation. We believe there is plenty of room for this strong market performance to continue, with further positive triggers in all major countries.

Poland celebrated a historic political turnaround, unlocking EU funds, equivalent to around 3.3% of GDP per annum in 2024-2026, more than three times the annual average since accession. We expect GDP growth of 4% or higher, which will also be supported by recovery in consumption, driven by positive real wage growth and increased social spending. We believe Poland's banking sector in particular is poised for a resurgence amid low valuations, higher-for-longer margins, best-in-class ROEs of up to 19% and dividend yields above 10%.

Greece has undergone a remarkable restructuring of its banking sector and public finances, bringing the country up to investment grade and closer to regaining its status as a developed market. Greek GDP growth is among the best in the EU, with average growth of 2-2.5% in 2023-2024. The Greek market offers both growth and value, particularly in the banking sector with an average P/E of 6x and the potential for strong profitability and rising dividends, while the energy sector stands out in terms of the pace of decarbonization and profitable growth.

Türkiye, in the midst of a process of “great normalisation” of monetary policy, presents compelling investment prospects with record low multiples of 4x P/E and strong market momentum, up 28% post-election2. The central bank’s policy rate has been raised to 45% attracting international investors back to the Turkish market and potentially stabilizing weak lira. Despite the challenges, Turkish equities offer a selection of resilient, high-quality companies with proven growth trajectories and the potential for significant returns.

Hidden gems in Eastern European countries such as Kazakhstan and Georgia offer unique investment opportunities in best-in-class companies in the fast-growing banking, fintech and e-commerce sectors at single-digit multiples.

East Capital New Europe

The East Capital New Europe fund was launched in 2019 to give investors exposure to the fast-growing countries of Eastern Europe excluding Russia. The three largest countries in the fund are Poland, Türkiye, and Greece, while 12 out of 15 are part of the European Union, significantly decreasing political risks. The fund offers unique exposure to high quality companies in Eastern Europe with a mix of strong growth, high dividend yield and value, coupled with our team's dynamic stock picking and robust investment process and full ESG integration. This mix helped the fund achieve a performance of 43% in 2023, outperforming the benchmark by 14%3. We remain optimistic for 2024 and look for the best selection of high-quality growth stocks with strong balance sheets. We continue to see significant upside potential in Central European markets, where valuations are still exceptionally low (Poland at 8.2x P/E, 22% discount to the 5-year average, Hungary at 5.8x P/E, 40% discount to the 5-year average). In addition, we see interesting stock-picking opportunities in Türkiye, which trades at 4x P/E, a discount of more than 40% to historical averages, and Kazakhstan, which is still close to the market bottom with a P/E of 3.6x for 2024e.

Overall, the East Capital New Europe Fund trades at a very undemanding 6.5x 2024e P/E, while offering 15% EBITDA growth. Despite the robust performance in 2023 and high double-digit earnings growth for many companies, valuations in Emerging Europe still offer a massive 54% discount to the Eurostoxx index and a 60% discount to Emerging Markets. In our meetings with companies, we continue to see high-quality stocks offering 20-30% year-on-year growth and trading at a 15-30% discount to historical averages. We have seen some positive drivers materialise in 2023, but expect further momentum to continue in 2024, along with the recovery in GDP and earnings and a further narrowing of risk premiums. We believe the eventual end of the war in Ukraine would further lower risk premiums/yields and support equities in the region over the medium to long term.

Eastern Europe – some of 2023’s best performing equity markets

Eastern European markets showed a robust recovery as the main risks from a tumultuous 2022 - geopolitical concerns over Russian aggression in Ukraine and an acute surge in inflation receded. Poland, Hungary, Greece, and Romania led this impressive resurgence, posting gains of 52%, 49%, 48%, and 63% respectively in USD. As a result, all markets have not only recouped their losses of 2022 but are well above pre-war levels. Further, Turkey is turning the corner and after a 21% decline in 1H’23, has staged a 28% post-election market recovery4. This resounding EE market rebound can be attributed to an improved economic outlook, a regional easing of inflationary pressures, sustained but moderate economic growth without a prolonged recession, sound government finances, deeply undervalued market conditions, and some positive changes in the political landscape.

Poland – back to ca. 4% GDP growth on strong consumption and unblocked EU funds

The victory of the democratic center-left opposition in Poland's parliamentary elections in October was well received by the market, which rallied 11% in the following month. Investors are welcoming the historic change in political direction that will return Poland to European values, free media, the rule of law and improved corporate governance of SOEs5. As a result, we are already seeing an improvement in Poland's relationship with the EU, as the new government has pledged to implement judicial reform to meet EU requirements for the release of funds. While many other EU countries have seen strong inflows of EU funds, Poland has seen significant delays in the release of the Recovery and Resilience Fund (RRF), which was allocated as far back as 2020, due to the unacceptable policies of the previous government. As a sign of goodwill, the EU has already released the first pre-payment of EUR 5 bn in December 2023, with further funds expected in H1 2024. In total, Poland could receive EUR 60 bn in grants and soft loans from the RRF, with a 2-3 year delay. In addition, Poland is expected to receive EUR 48 bn in net cohesion funds from the EU budget for 2021-2027. As a result, we expect net inflows of EU funds to average EUR 28 bn (3.3% of GDP) per year in 2024-2026, almost three and a half times the annual average since accession and 80% higher than in the last funding period, which should significantly support Poland's future GDP growth. Although the risk of delays in spending remains, the new government should spend money on projects/areas that will generate the highest returns and support the future growth of the Polish economy.

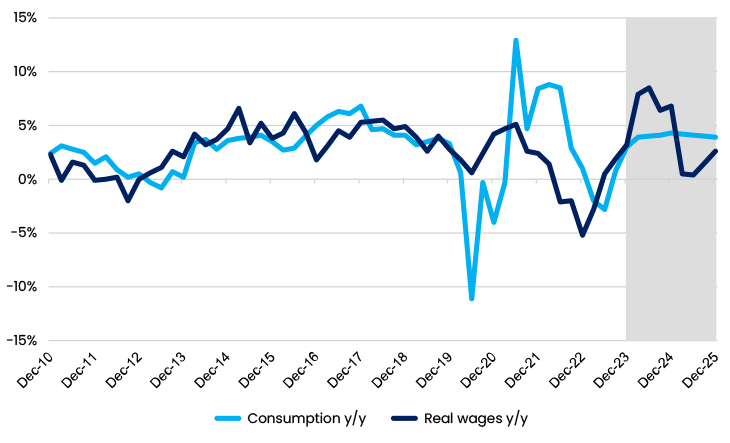

EU funds are not the only reason why we expect GDP to grow by around 4% yoy in 2024. With inflation falling sharply in 2023, real wage growth is expected to turn positive in 2024 - a strong indicator of a recovery in consumption, which is expected to grow by 4% y/y and become another key driver of GDP growth. In addition, the new government plans to support the population's living standards by increasing social spending, i.e., further raising child benefits, cutting taxes, and increasing public sector salaries, which will contribute an additional 3% of GDP and up to 5% of private consumption in 2024. As a result of this strong boost to investment and consumption, Poland should once again be one of the fastest growing economies in the world, growing at four times the expected EU average. In this positive environment, we are excited by the prospects of companies such as LPP, the region's leading fashion retailer, whose sales area is growing by 20% y/y and whose EBITDA is expected to grow by 15% y/y in 2024, trading at 6.6x EV/EBITDA. We also like InPost, a parcel machine operator exposed to a fast-growing e-commerce market and consumer, which could grow EBITDA by 29% y/y this year, while trading at an undemanding 10.4x EV/EBITDA.

Consumption vs. real wages

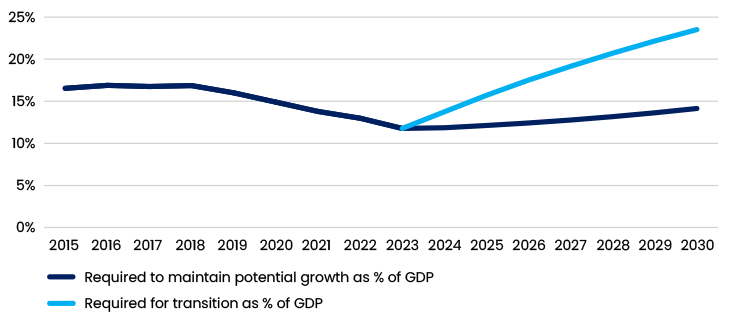

Banks are another key sector that investors should not overlook. For years Polish banks have been tormented by unfavorable regulatory interventions, the demise of CHF loans, and a low interest rate environment, which have limited margins and capped their ROEs to a meager 6-8% in 2016-2020. The tide is finally turning for the sector, with a higher-for-longer inflation and interest rate environment promising higher-for-longer margins and returns. Polish banks' core earnings are growing at an outstanding 50% CAGR between 2020-2023 and stabilizing at that elevated level in 2024. Higher-for-longer rates suggested by the central bank would be incredibly positive for Polish banks, which have ample deposits, and most of their loan book is based on floating rates and are therefore poised to benefit from higher interest rates, resulting in outstanding ROEs of 15-19%6. Another important driver for Polish banks could be the revival of lending. The EU needs to invest more than EUR 745 bn per year to meet the goals of the Green Deal, RepowerEU and the digital transition7. Unfortunately, Poland is lagging in this important transition. We calculate that to catch up with these investments Poland would need to EUR 26.2 bn annually8, creating an additional bank lending demand to cofinance these investments of EUR 16 bn per year (2% of GDP, 17% of outstanding bank loans). Such a significant investment implies that the volume of bank lending should grow by 12-25% yoy in the coming years, instead of the 5-10% currently forecasted. All the above would add another 10-12% to banks' net profits in 2024 vs. market expectations, with our preferred banks, PKO and Pekao, posting 18-19% ROEs and paying an attractive 7-11% dividend yield for 2024, while trading at 7x P/E. We still see significant upside in these higher-quality banks, as they still trade at a 38% discount to EMEA banks and significantly outgrow European banks in profits.

Poland – bank lending as % of GDP

Greece – bolstered by the investment grade and ready for the investment led growth

Greece, while duly recognized for its successful post-covid revival of tourism and its warm hospitality, should finally get some well-deserved praise for being among the best EU countries in terms of growth, public finances, investments as well as successfully leaving bank crisis behind. Greece's GDP will grow by 2-2.5% in both 2023-2024E, underpinned by strong investment growth of 13% CAGR in 2023-2026 after more than a decade of significant underinvestment. With market-friendly policies, outstanding growth and a new investment grade rating, the Greek market remains buoyant and offers a wealth of opportunities, particularly in the banking and energy sectors.

Investments to grow 13% 3Y CAGR after decade of underinvestment

Following a successful restructuring, Greek banks are now highly profitable and most are willing to pay out 50-60% of their profits as dividends, meaning that, once allowed by regulators, they could increase dividend yields to as much as 10% (2025e), while some banks offering buybacks, such as the National Bank of Greece, could achieve an all-in yield of 9%-14%. Conversely, Alpha Bank offers exceptional value, trading on just 0.5x P/B in 2024, despite the strong profitability of its Greek operations. Interestingly, the recent deal with Unicredit has valued Alpha Bank's Romanian operations at 1.2x P/B. Once their Romanian bank is merged with Unicredit's Romanian unit, they will have exposure to the third largest bank in Romania, where banks enjoy higher profitability and valuations than in Greece. Growth in the Greek banking sector can be found in smaller challenger banks such as Optima Bank, a fast-growing and lean disruptor offering a blend of value, growth, and high yield. With an impressive ROE of 26% in 2023 and net income expected to grow at a CAGR of 28% between 2023 and 2025, it stands out as one of the highest-quality, fastest-growing banks in the eurozone.

In the energy sector, Greek companies that have embraced the energy transition have delivered impressive returns to shareholders while continuing to grow at attractive multiples. PPC, for example, has undergone a remarkable transformation from an inefficient and polluting utility to a fast-growing renewable energy powerhouse, with its share price up 877% over the past 5 years. Trading at 5.2x EV/EBITDA '24, PPC remains one of the cheapest and fastest growing utilities in Europe. These positive developments are taking Greece further down the road to regaining developed market status, a major milestone expected to be reached in 2025.

Türkiye – on the way to “the great normalisation”

Türkiye is embarking on what some analysts are calling “the great normalisation”, the implementation of tight monetary policies to combat inflation—a strategy that seemed improbable in the first half of 2023 because of Erdoğan’s preference for unorthodox low interest rate policies to boost growth at the expense of high inflation. Led by a newly assembled and highly qualified economic team, the country is moving away from an ultra-loose monetary policy that previously anchored the policy rate at 8.5% amid staggering inflation rates ranging from 38% to 86% since mid-2022, now hovering around 65%. This shift is aimed at controlling inflation rather than fanning the flames. The current policy rate is 45% and the new central bank governor, appointed in February 2024, has signaled that the door is open to further rate hikes if needed to keep inflationary pressures under control. Despite the recent leadership changes at the central bank and persistently high inflation, which keeps risks elevated, both the central bank and the finance minister have reassured investors of their commitment to tight monetary policy until inflation comes down. Historically, the successful execution of such turnaround strategies has led to substantial returns for investors.

The cost to the equity market of past economic mismanagement comes in many forms, but is most evident in the P/E ratio, which stands at 4.0x for 2024e. A well-executed normalisation process has the potential to double this multiple. Even without P/E multiple expansion, Türkiye has numerous resilient companies with proven growth trajectories, such as discount food retailers Bim and Sok, which grew stores by 10% and 11% per year on average between 2019 and 2023, respectively. However, navigating the uncertainties of policy changes and volatile markets requires the expertise of experienced portfolio managers who can identify significant upside potential while limiting downside risks. Given the complexities and risks, we continue to actively manage our Turkish exposure through frequent meetings and local visits. This hands-on approach has helped us to navigate between well-performing Turkish domestic equities, banks and lagging industrials, generating a significant return of 23% (USD) on our Turkish holdings in the New Europe Fund in 2023, outperforming the Turkish holdings in the index (-8%) as well as the competition.

Hidden gems of Frontier Europe

Few investors would guess that the largest company by market capitalization in the entire Eastern European region is in Kazakhstan, and even fewer would guess that this company has just completed a USD 1 billion placement on the U.S. Nasdaq. The company is Kaspi, a highly innovative fintech that has moved away from consumer lending to become a true super-app for both consumers and merchants. Its success is most evident in its engagement rates, with 65% of its 13.5 million monthly users using the app daily – well ahead of WhatsApp (53%) and Nubank (39%), and only behind WeChat (86%) globally. We have been a significant investor in Kaspi since its IPO in 2020 and have seen a spectacular return of 274% since then. We believe the Nasdaq listing will put both the company and the region on the map for U.S. investors, where the "deepest pockets" are clearly to be found. As such, we remain positive on the stock, which trades at a remarkably low 8x 2024 P/E with 20% high visibility earnings growth. By comparison, peers such as Nubank in Brazil trade at 25x P/E. Such discounts can also be found in other names in the country, such as the world's leading uranium producer Kazatomprom, which trades at 8x P/E for 2024, compared to 35x P/E for the second largest producer, Canada's Cameco. These low valuations are explained by Kazakhstan's liquidity and remoteness rather than any structural issues - the IMF expects GDP growth of 3.1% and 5.7% in 2024 and 2025 respectively, with a balanced fiscal stance (0.2% of GDP in 2024) and a broadly balanced current account (-0.7% of GDP). As in the broader region, one of the main triggers for a re-rating would be some sort of peace agreement in Ukraine, which we continue to hope for, although it is difficult to predict.

We see a similar story in Georgia, where we like the high-quality London-listed bank TBC. Our analysis shows that TBC's current low valuation of 4x 2024 P/E means we get the bank's exciting and fast-growing fintech operations in Uzbekistan for free. Crucially, these Uzbek operations are already profitable, accounting for around 5% of net profit in 2023, although we believe they will account for more than 15% in a few years' time.

1 in USD terms.

2 in USD terms.

3 in USD, net of fees.

4 Total returns from July 1, 2023 to February 9, 2024 in USD.

5 State-owned enterprises, which represent significant share of the Polish equity market.

6 2024 ROE range of Polish banks, adjusted for one-offs.

7 Combined target by European Commission for EU’s Green Deal, RepowerEU and digital transition.

8 Calculated as Polish share of the EU investments relative to the share of Polish GDP in the GDP of EU.